Fall in love with FreshBooks 🍂 Get 50% Off for 6 Months. Buy Now & Save

50% Off for 6 Months Buy Now & Save

Best trucking accounting software

No credit card required. Cancel anytime.

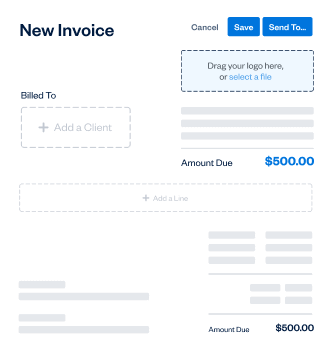

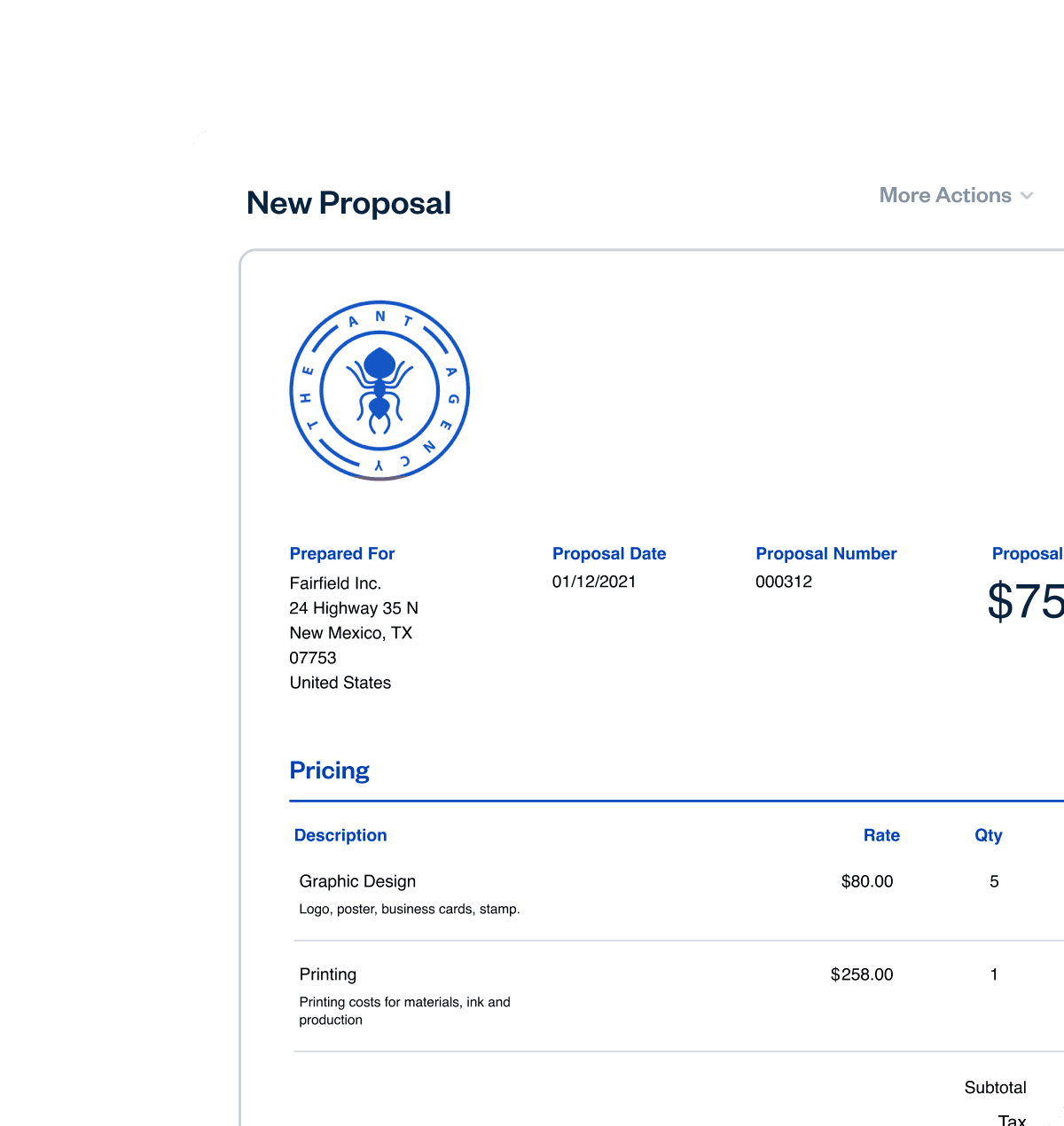

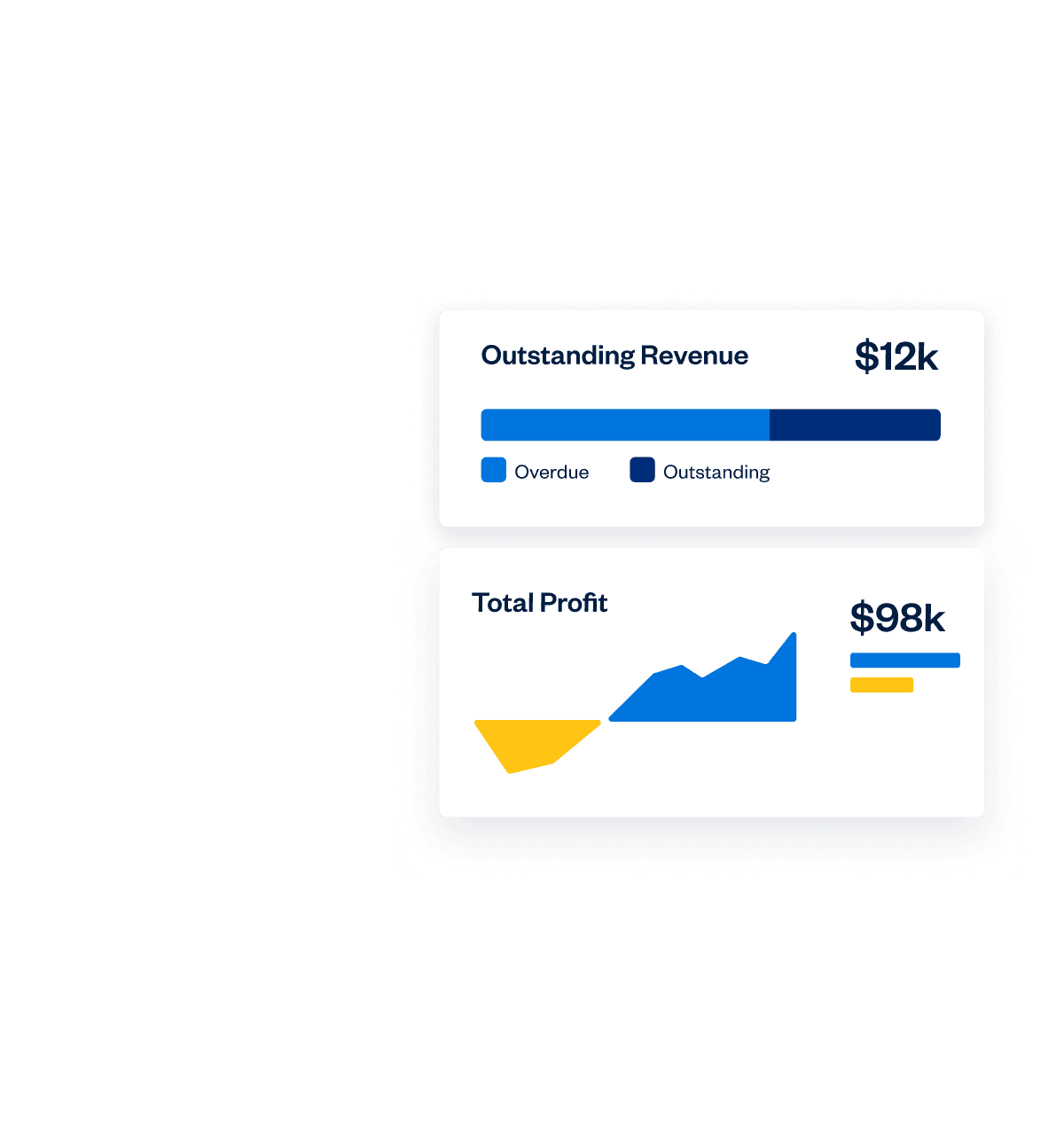

Streamline freight invoicing and payment processing

FreshBooks accounting software simplifies freight invoicing, payment processing, and overall financial transactions, helping trucking companies get paid faster and more efficiently. Create professional-looking invoices in seconds, automate payment reminders, and accept online payments to improve cash flow.

Track fuel costs and mileage for accurate expense management

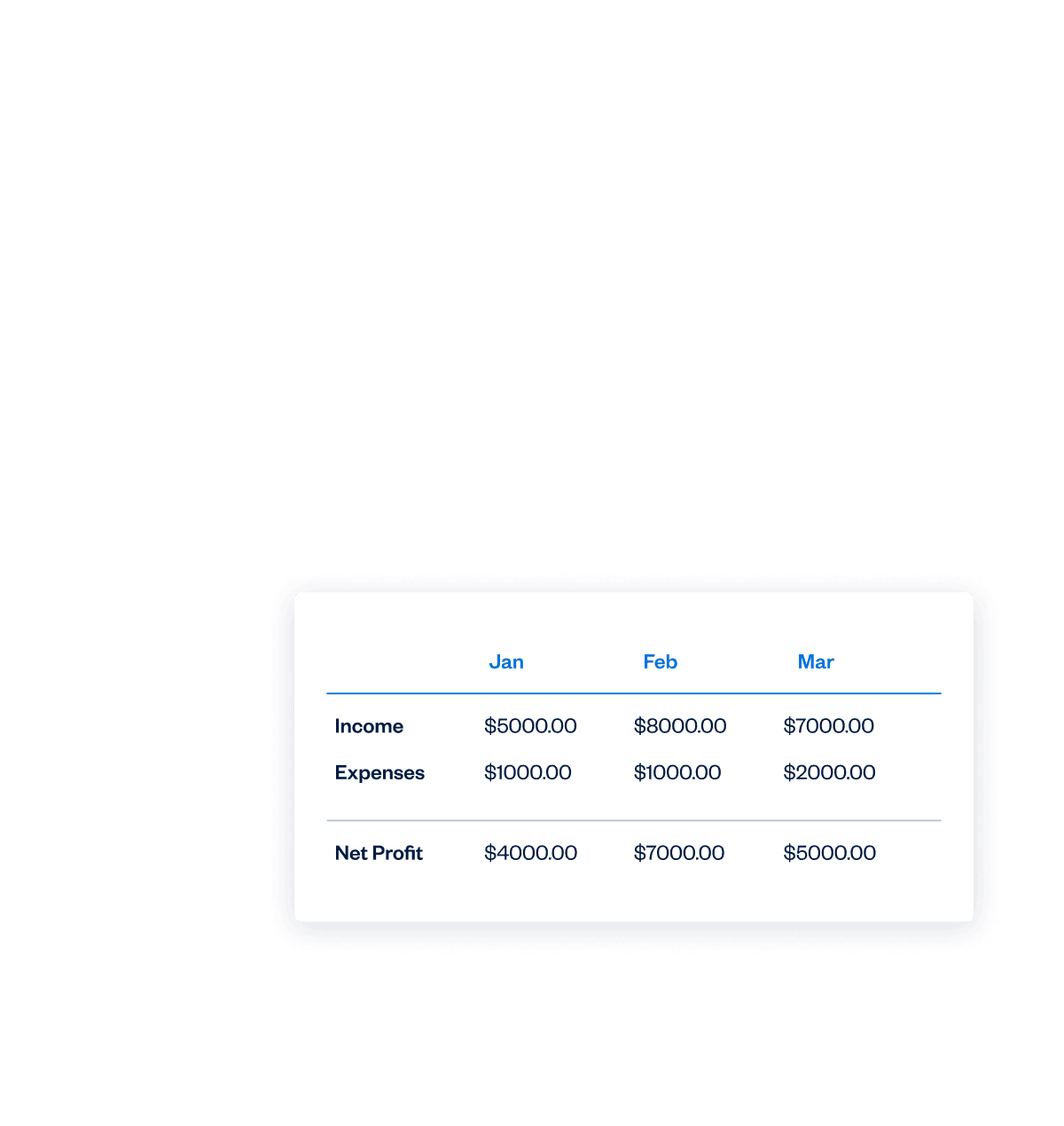

Track expenses accurately, including fuel costs and mileage, with FreshBooks. Monitor fuel consumption, record mileage, and categorize expenses to gain insights into profitability and ensure precise financial reporting for your trucking business.

Automate payroll for drivers and staff

FreshBooks automates payroll for drivers and staff, reducing errors and ensuring timely payments. Manage driver pay, calculate deductions, and handle payroll taxes with ease, streamlining your payroll process and maintaining compliance.

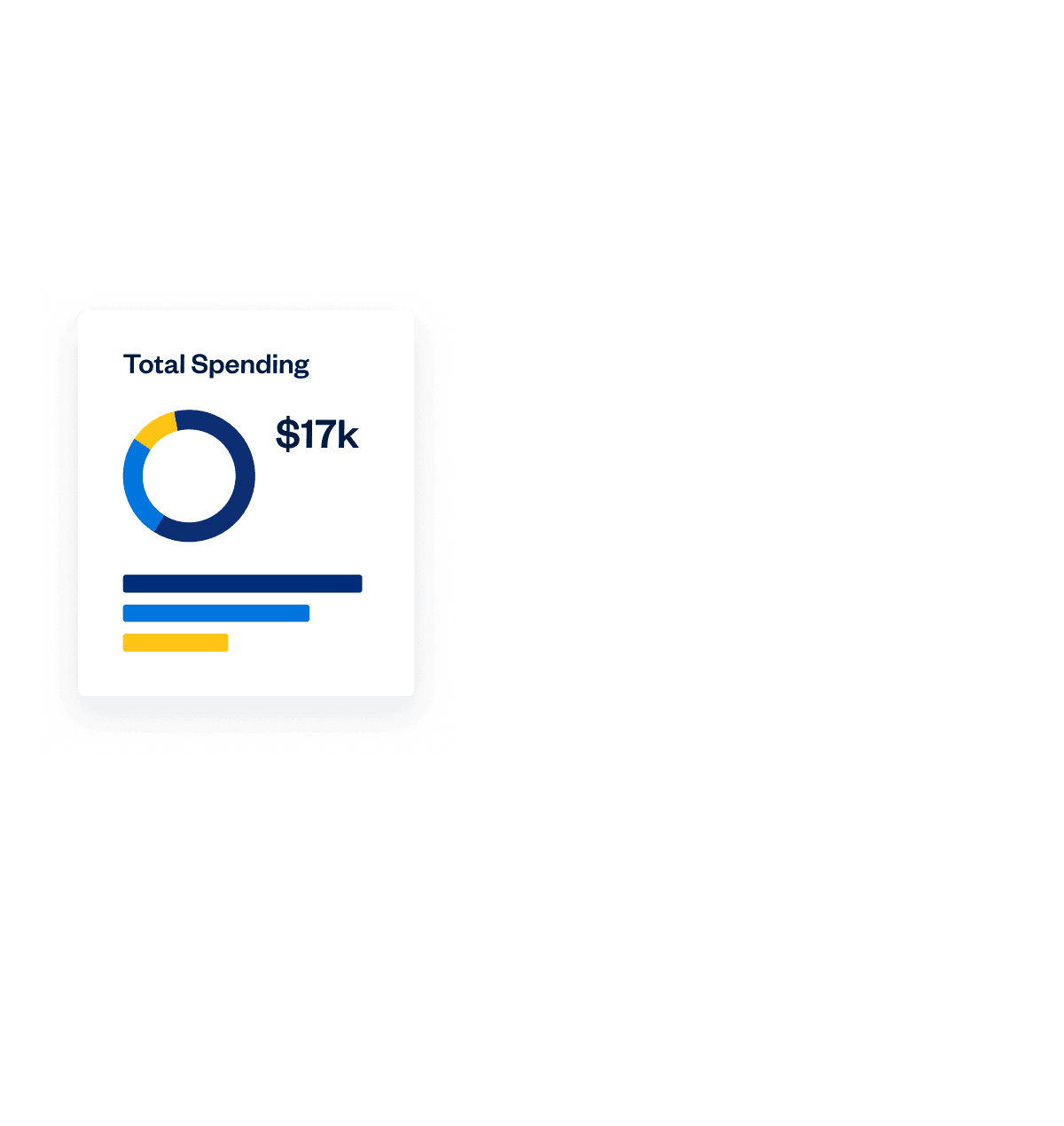

Monitor fleet expenses and maintenance costs

Keep a close eye on fleet expenses and maintenance costs with FreshBooks. Track vehicle repairs, maintenance schedules, and other related expenses to control costs, optimize resource allocation, and make informed decisions about your fleet. Monitoring these expenses also contributes to operational efficiency by streamlining financial operations and enhancing overall management tasks.

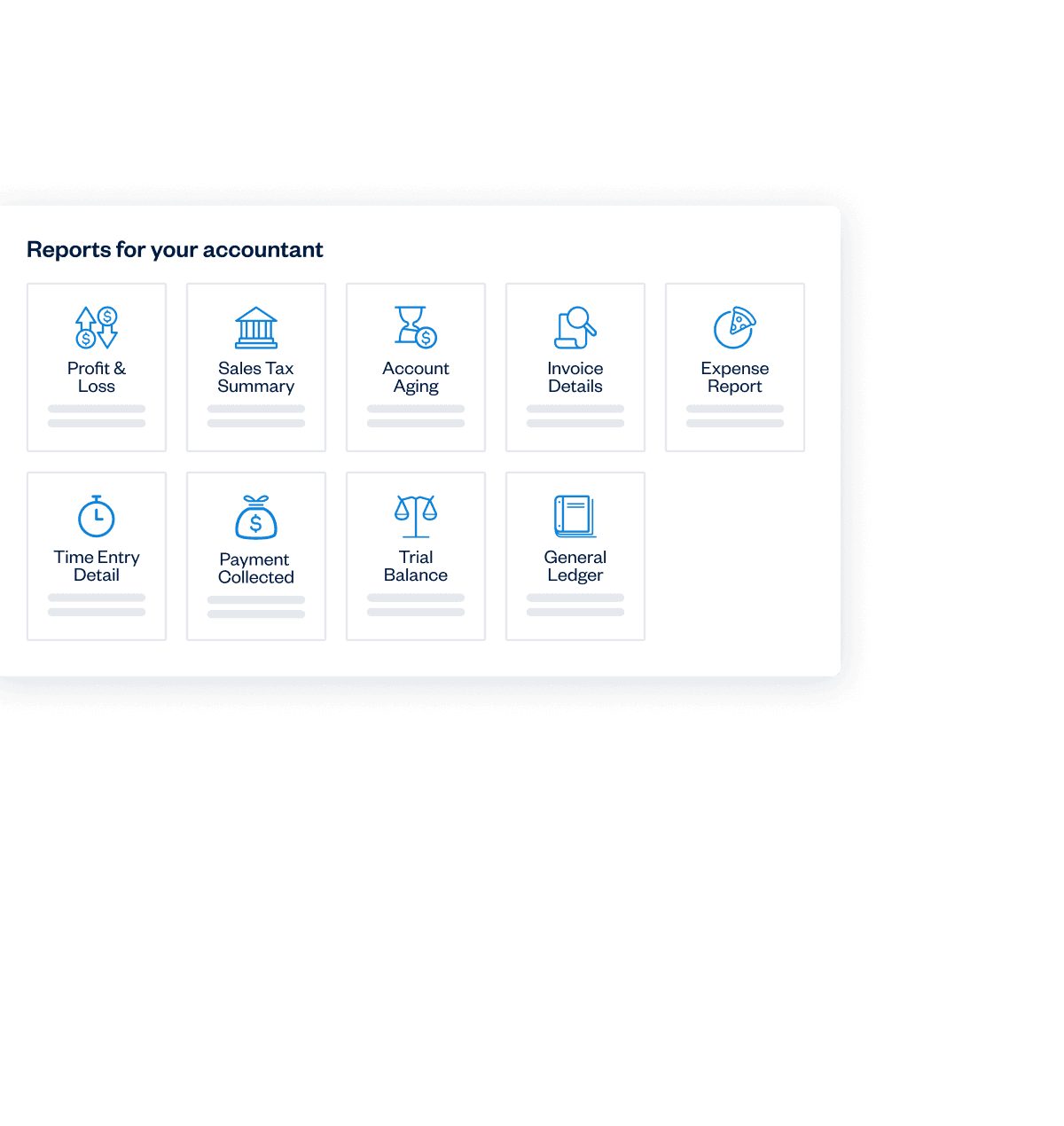

Ensure compliance with tax and regulatory requirements

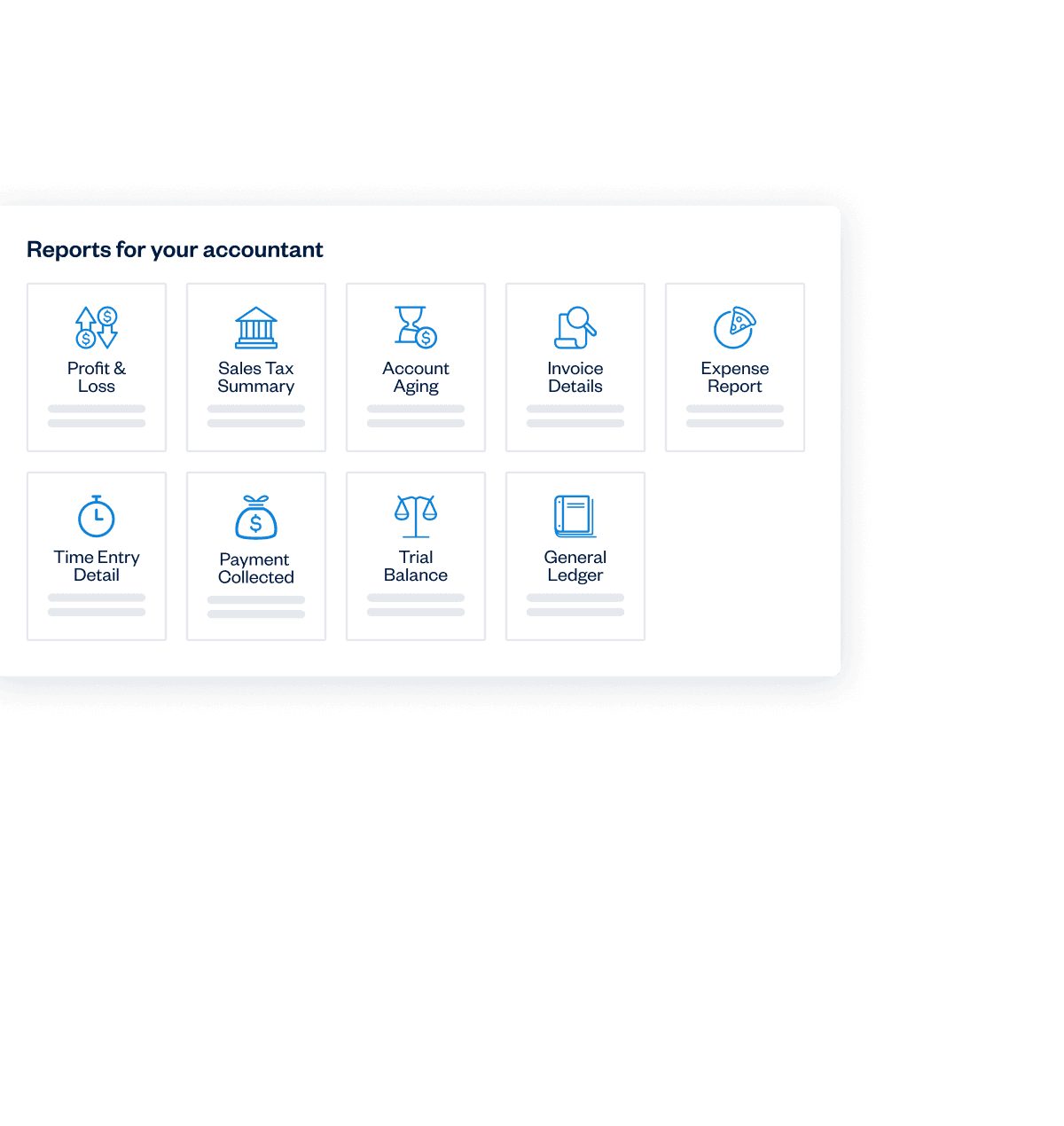

Stay compliant with tax and regulatory requirements using FreshBooks. The software helps trucking companies adhere to industry-specific regulations, track tax-deductible expenses, and generate accurate reports for tax filings, reducing the risk of penalties and audits. Additionally, FreshBooks helps generate accurate financial statements to keep you financially and tax compliant year-round.

Track fuel costs and mileage for accurate expense management

Track expenses accurately, including fuel costs and mileage, with FreshBooks. Monitor fuel consumption, record mileage, and categorize expenses to gain insights into profitability and ensure precise financial reporting for your trucking business.

Trucking accounting software with all the features you need

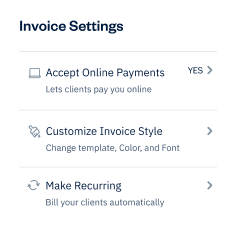

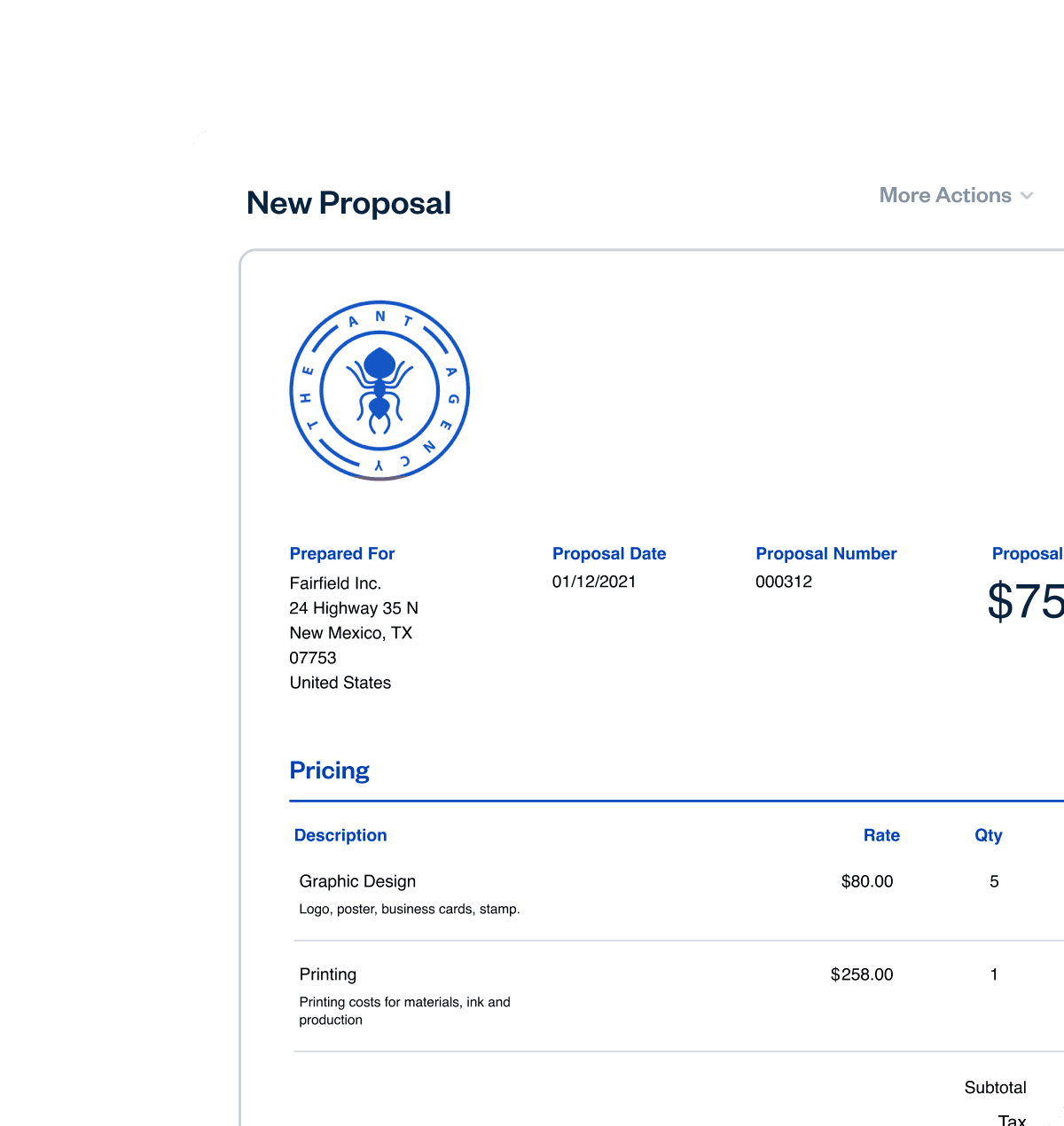

Invoicing

Create professional invoices in minutes. Automatically add tracked time and expenses, calculate taxes, and customize your payment options.

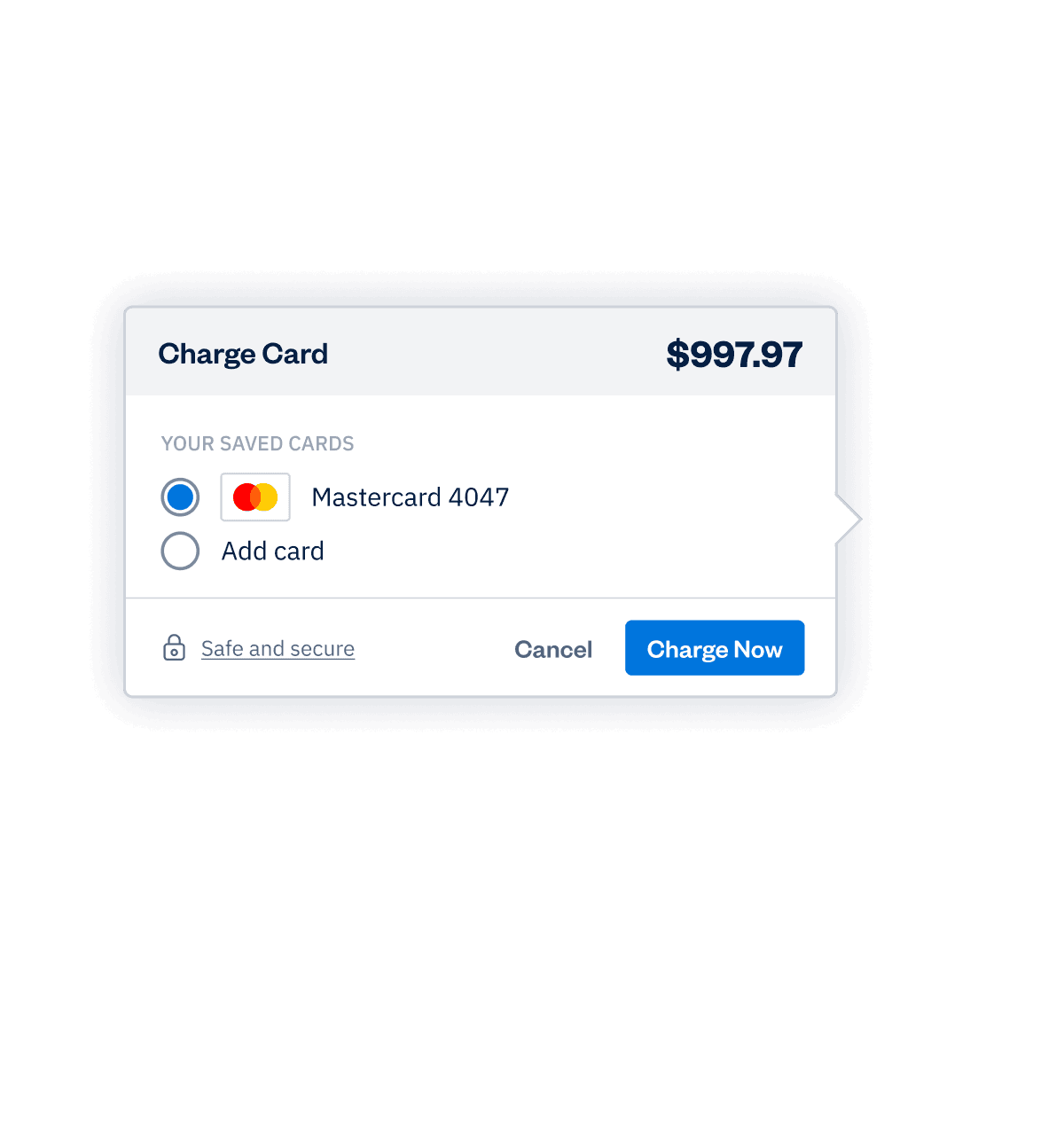

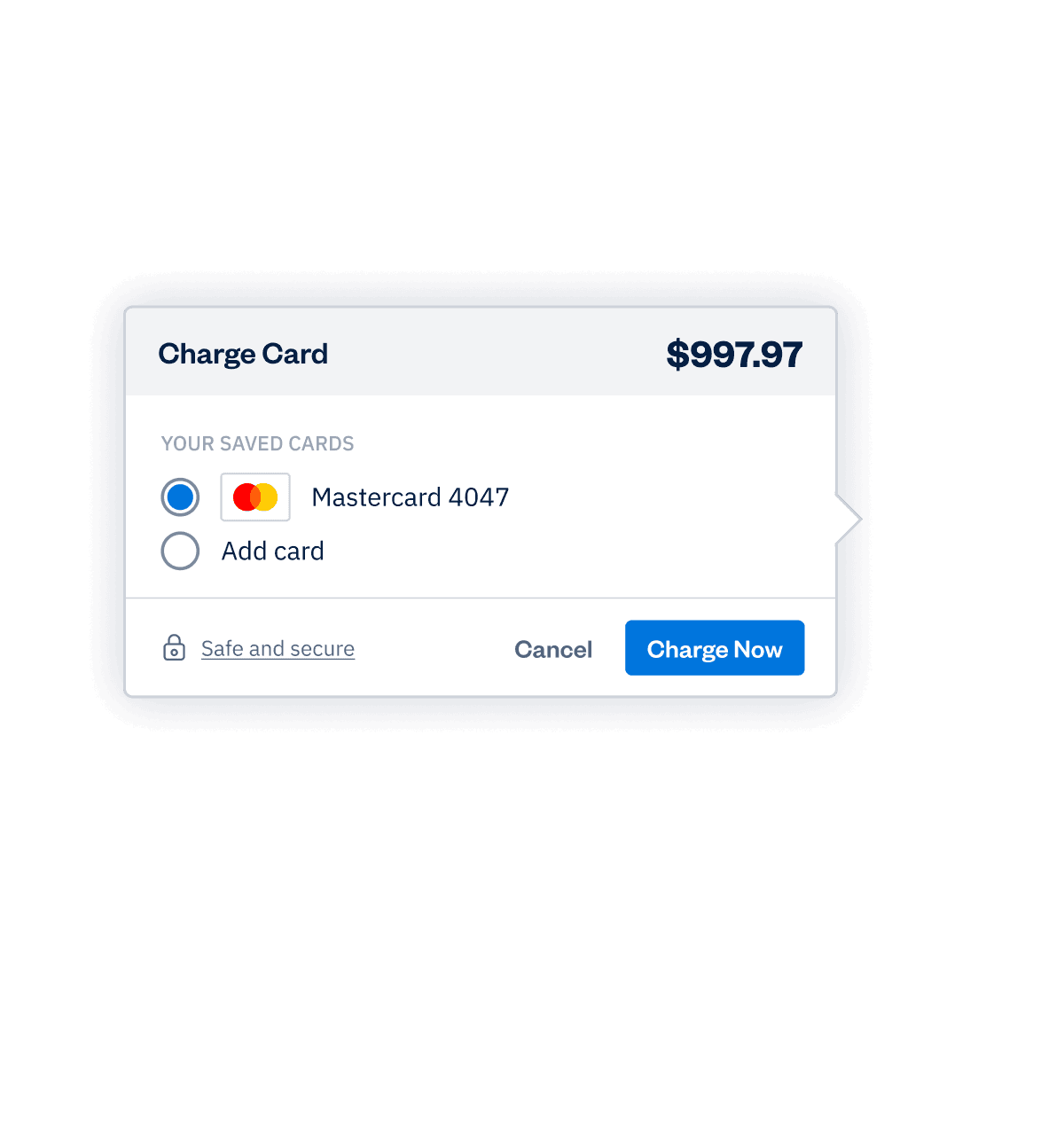

Billing and Payments

Bill fast, get paid even faster, and automate the rest with recurring invoices, online payments, and late payment reminders.

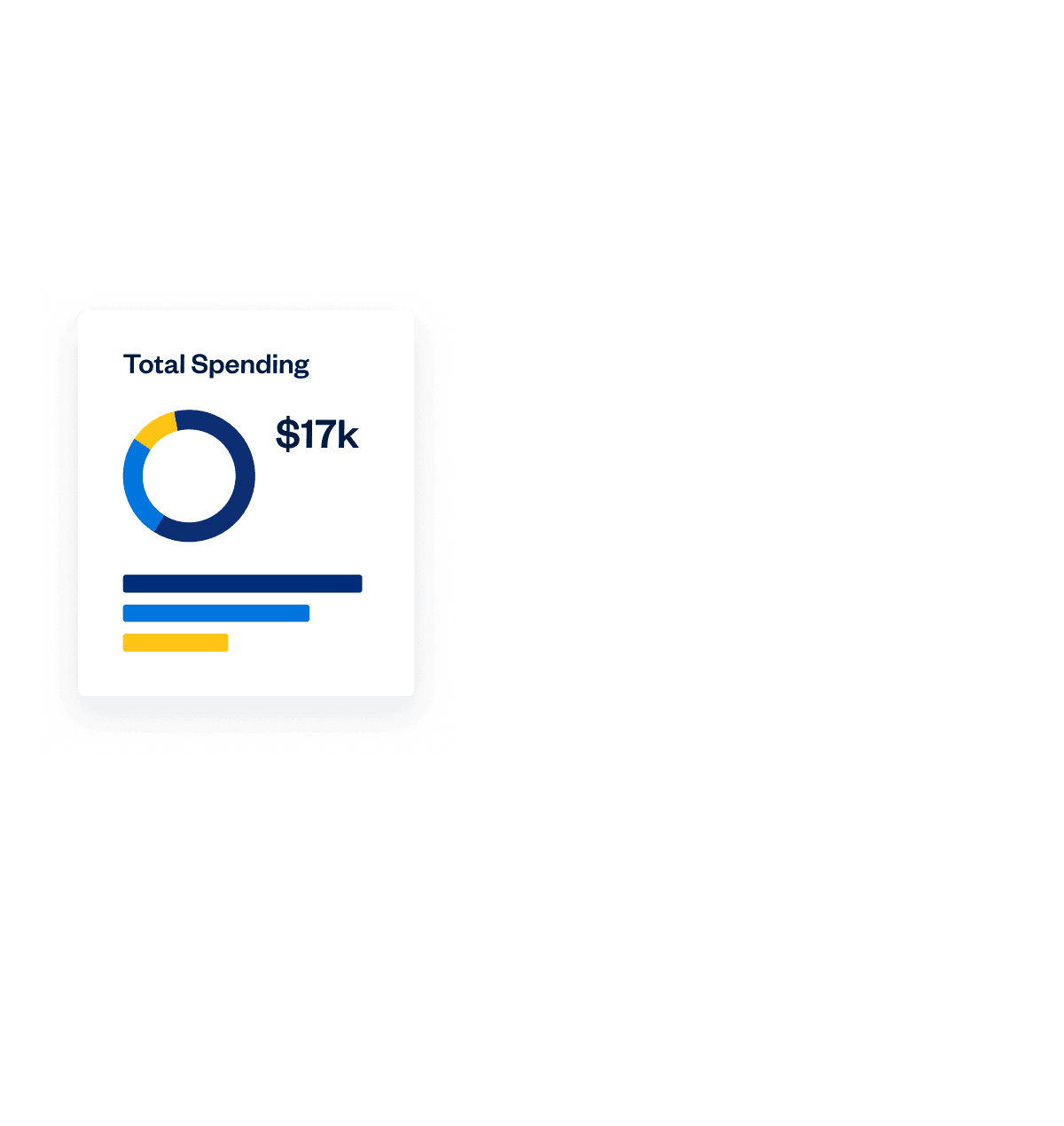

Expenses

Keep track of your expenses with mobile receipt scanning, bank account imports, and automated expense categorization.

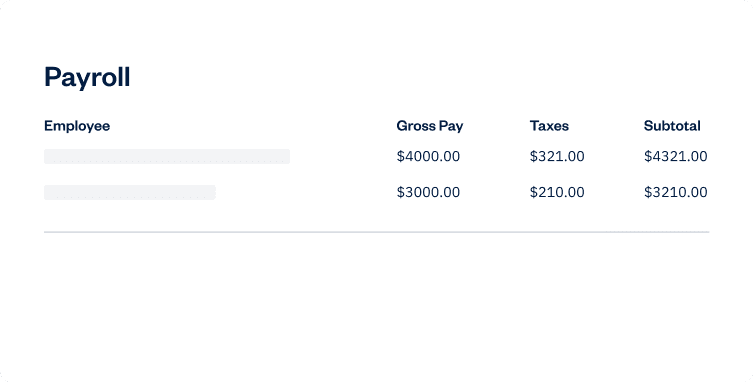

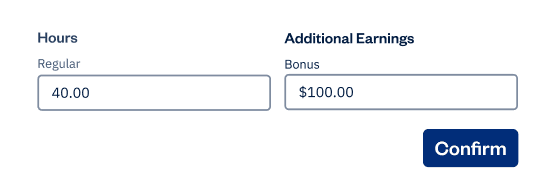

Payroll

The simplest way to pay yourself and your team. Seamlessly run payroll, track expenses, and calculate taxes without juggling separate tools.

Automate your trucking finances and save time

Get paid faster with easy invoicing and payments

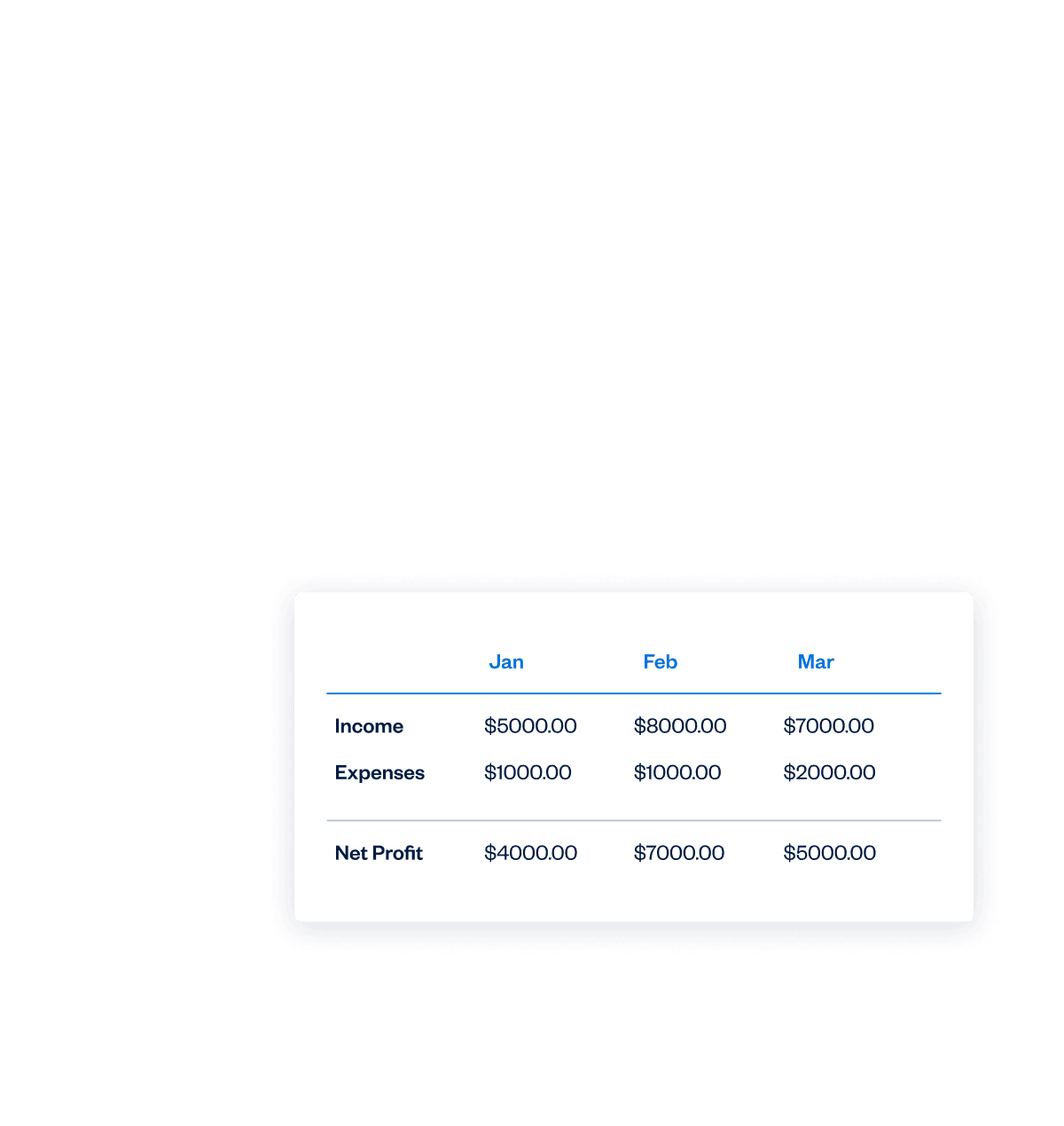

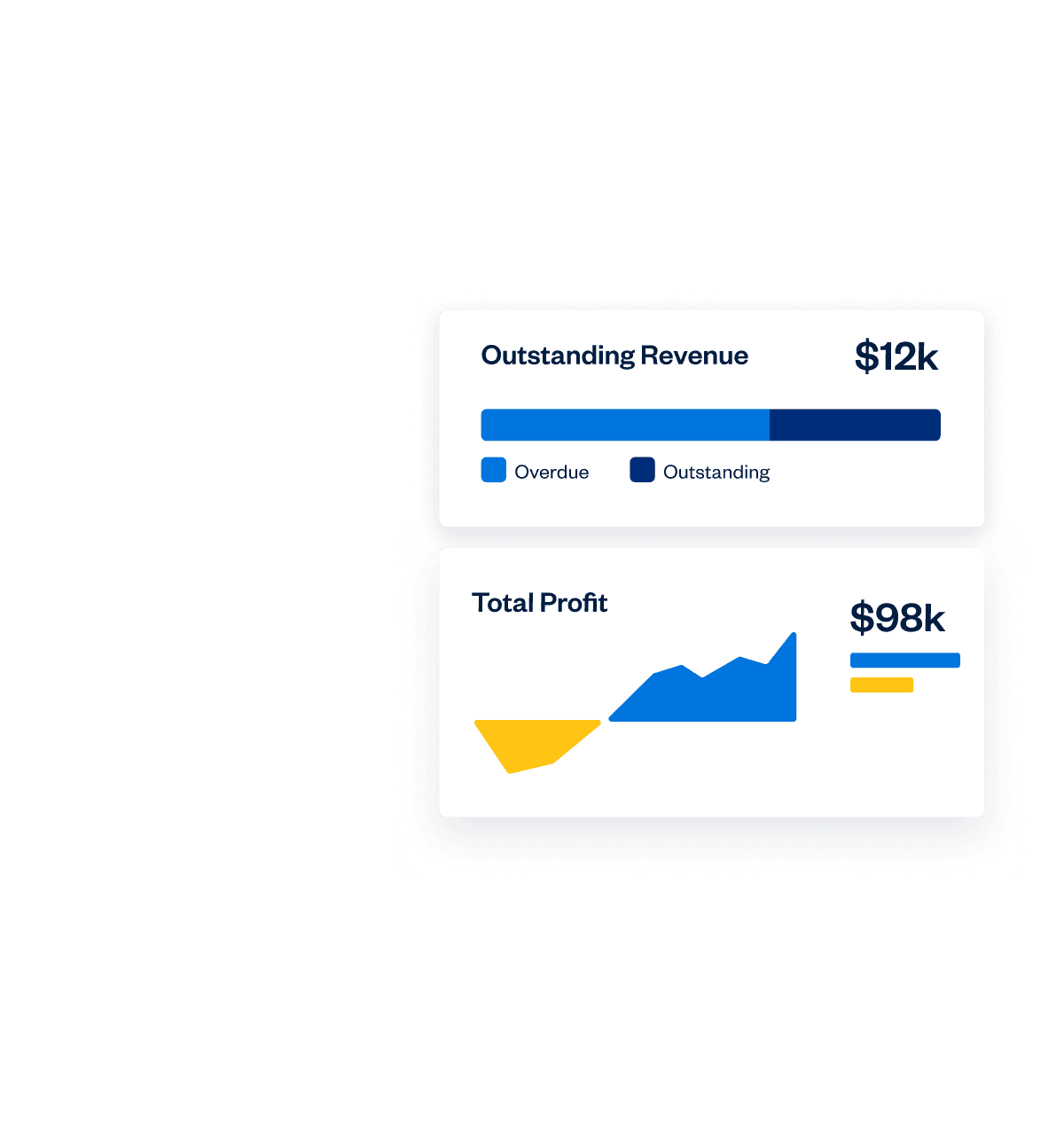

Track your trucking finances in real-time

Automate your trucking finances and save time

Get paid faster with easy invoicing and payments

Track your trucking finances in real-time

Automate your trucking finances and save time

Get paid faster with easy invoicing and payments

Track your trucking finances in real-time

Free vs. FreshBooks accounting software for trucking companies

Free accounting software might seem good for trucking companies at first, but it often lacks important features like invoicing, tracking expenses, and reporting. This can make it harder to manage your business as it grows.

FreshBooks is a better choice. It has tools designed for trucking businesses, helping you easily track expenses, send invoices, and get paid faster.

Compared to free software, FreshBooks also gives you secure data storage, helpful customer support, and works smoothly with other business tools.

With FreshBooks, you get the tools you need to manage your finances and grow your trucking company, providing a comprehensive solution without spending too much money.

Why trucking companies choose FreshBooks:

The reviews say it all.

4.5 Outstanding

FreshBooks offers a well-rounded, intuitive, and attractive double-entry accounting experience. It anticipates the needs of freelancers and small businesses well—better than competitors in this class.

4.5 Excellent

FreshBooks automates daily accounting activities namely invoice creation, payment acceptance, expenses tracking, billable time tracking, and financial reporting.

4.5 Excellent

FreshBooks is an online accounting and invoicing service that saves you time and makes you look professional – Fortune 500 professional.

4.7 Excellent

FreshBooks makes it easy to stay organized, keep track of payments owed and expenses made, send invoices and accept payments.

4.5 Outstanding

FreshBooks offers a well-rounded, intuitive, and attractive double-entry accounting experience. It anticipates the needs of freelancers and small businesses well—better than competitors in this class.

100+ apps.

Accounting apps and integrations for trucking companies

FreshBooks integrates with 100+ apps, giving you greater control over your trucking company's accounting and enabling you to customize your FreshBooks workflows to suit your specific needs.

See All Apps

Support that actually supports you

Help From Start to Finish

Our Support team is knowledgeable and never transfers you to other departments.

4.8/5.0 Star Reviews

Yup, that’s our Support team approval rating across 120,000+ reviews

Global Support

We’ve got over 100 Support staff working across North America

Help From Start to Finish

Our Support team is knowledgeable and never transfers you to other departments.

Accounting software

by industry

Feeling overwhelmed by bookkeeping? FreshBooks offers industry-specific accounting software that simplifies finances and boosts efficiency, letting you focus on what truly matters. Visit our industry pages below to learn how FreshBooks can fulfill all your accounting needs!

Resources to support trucking businesses

How to Start a Successful Trucking Company

13 Truck Driver Tax Deductions You Need to Know

How to Calculate Cost Per Mile for a Trucking Company?

Frequently Asked Questions

Keep your trucking

finances on the right track