Signals for U.S. Economic Growth

How Small Businesses Contribute to Economic Recovery

In this report, we examine expense trends in small and medium-sized companies, and how and where they’re spending. This perspective is valuable to understand the path that America’s economic recovery is taking.

Here’s What We Found

Freelancers and small business owners are adaptable and resilient (surprise, surprise). In 2020, they shifted their ways of doing business and put a focus on salaries, wages, and healthcare — the basics of what it means for a business to be sustainable.

Spending On Supplies and Wages Increased During the Pandemic

In 2020, supplies and wages experienced the highest volume increase of all business expense categories (Supplies 24.11%, Wages 23.66%).

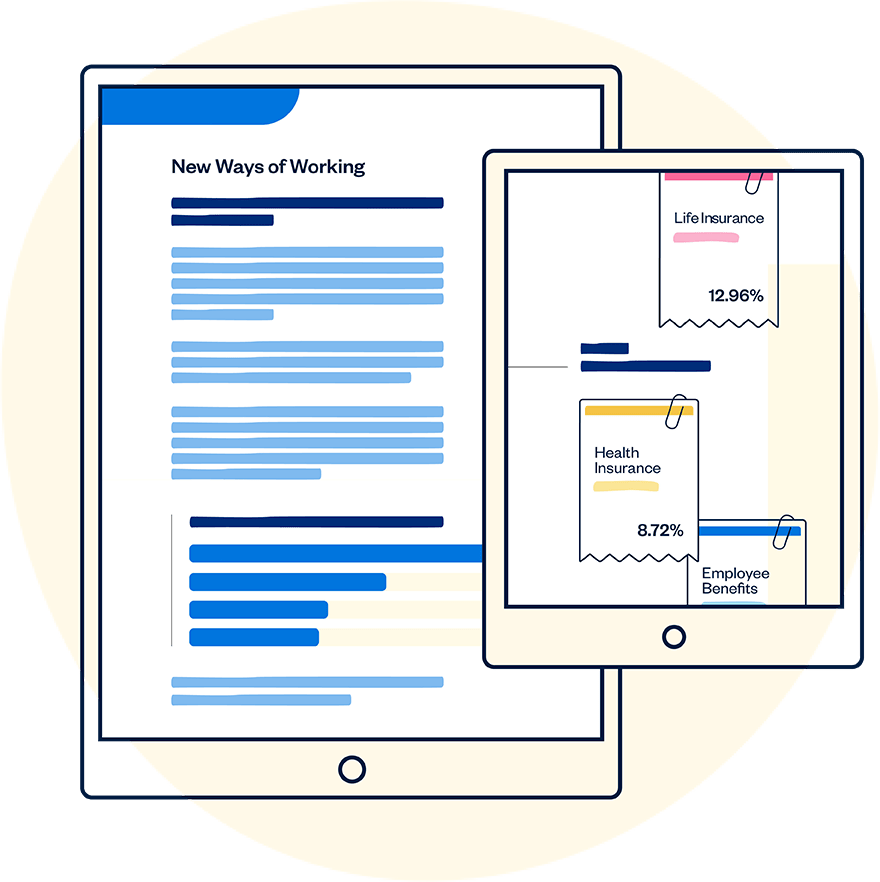

Spending on Life Insurance, Benefits, and Health Insurance Also Increased

During the pandemic, it became more expensive for smaller firms to take care of their employees. Life Insurance spending saw a 12.96% increase over the course of 2020.

Expenses Related to In-Person Experiences Are Declining Due to Remote Work

Of course, expenses related to travel (-24.14%) and airfare (-35.56%) saw a decline throughout the pandemic, but there are a host of in-person-related expenses that also took a big hit.