Canadian Women-Owned Small Businesses Taking Twice as Long To Recover From COVID-19 Compared to Businesses Owned by Men

During the last nine months, people everywhere have dramatically shifted the way they live. Everyone has been affected by COVID-19, but it’s clear that one of the hardest hit groups have been small business owners. While being a small business owner has perhaps never been this difficult, new research conducted by FreshBooks confirms that businesses owned by women are, in fact, the hardest hit

While researching key performance indicators of small businesses (including metrics like new clients added, new revenue, and new invoices generated), FreshBooks uncovered:

✅ On average, women-owned businesses are taking nearly two times longer to recover from the financial setbacks brought on by COVID-19 compared to businesses owned by men.

✅ Self-employed women in industries that rebounded quickly are still under-indexing and recovering much slower than their male counterparts (for example, the construction industry).

✅ Industries that are normally women-dominant (e.g. healthcare and social assistance) are now seeing male-owned businesses recovering significantly faster.

✅ Industries that were hardest hit during social distancing regulations (e.g., education, social assistance, etc), are predominantly owned by women.

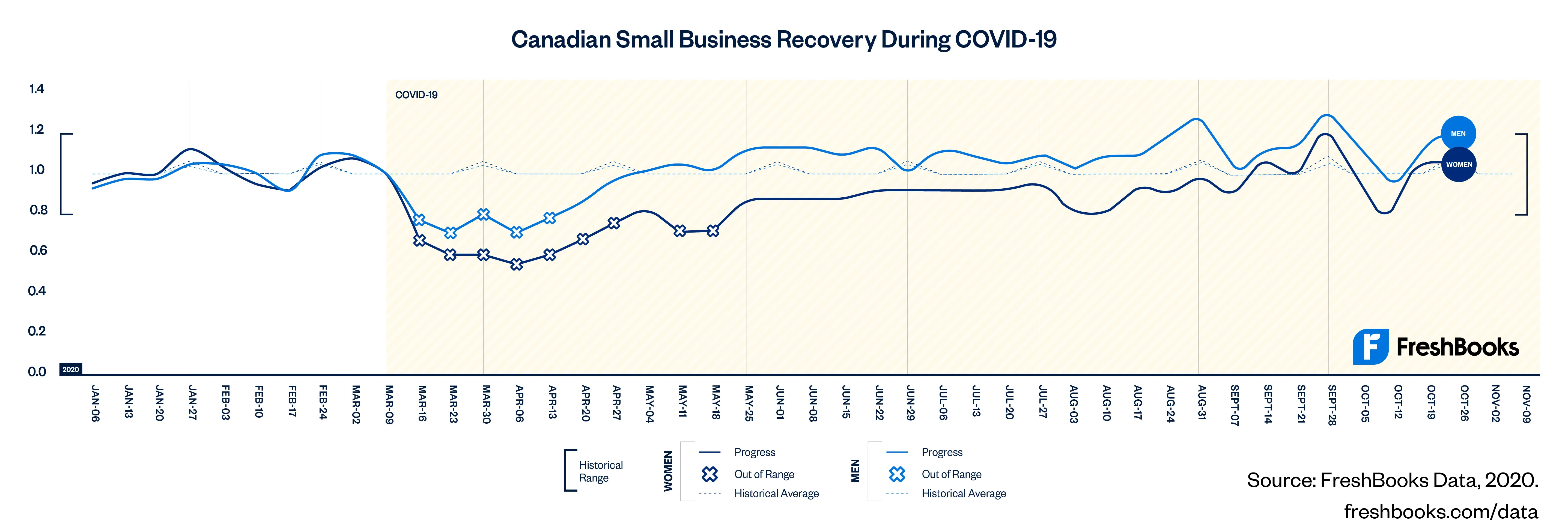

Across all industries, women-owned businesses are taking nearly twice as long as their male counterparts to rebound from the downturn in their business brought on by COVID-19.

The graph above shows that it took Canadian women-owned businesses ten weeks to begin to rebound, while it took Canadian men-owned businesses five weeks to begin their recovery. In the case of women-owned businesses, even while recovering they were still falling below their historical average, while men surpassed their historical average soon after the recovery began.

Ultimately, once recovery started, it took businesses owned by men three weeks to get back to their historical average, while it took businesses owned by women 13 weeks. Additionally, businesses owned by men have surpassed their historical averages on numerous occasions over the last six months, while women-owned businesses are still largely below their historical average.

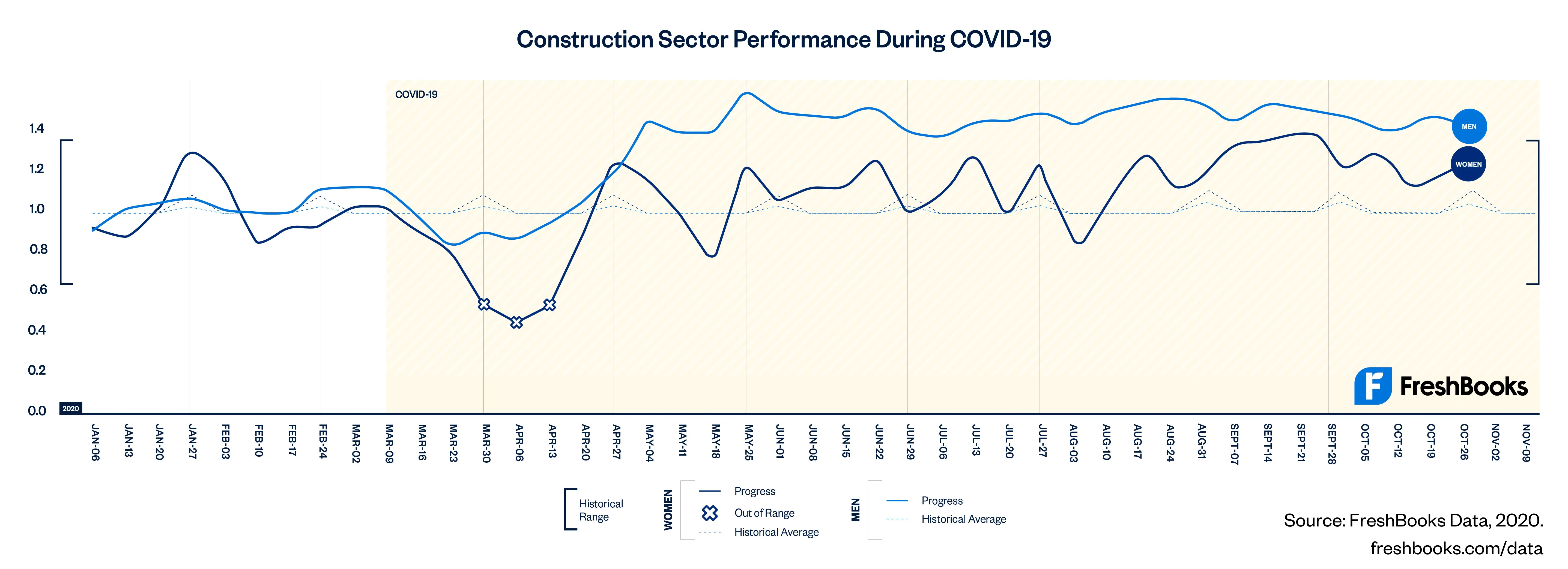

Because people are spending more time at home, the Canadian construction industry experienced a huge boom, but women-owned construction companies did not see the same success, and are experiencing a slower rebound and more volatility.

The key to success in service-based industries like construction is new clients. In the case of Canadian construction companies, businesses owned by men experienced no interruption in client acquisition, while Canadian women-owned businesses experienced three consistent weeks of adding less than their average number of clients. In addition, women-owned construction companies have experienced a lot more volatility than their male counterparts; while businesses owned by men have seen significant and quick growth, women-owned businesses are seeing peaks and valleys instead of regular continuity of business.

In terms of revenue, women-owned construction companies experienced three consistent weeks where their revenue fell out of range from their historical average, whereas male-owned businesses had one week where their revenue fell slightly out of range.

The good news is that as a whole, the construction industry is doing well, and both men- and women-owned companies seem to be performing above average over the last three months.

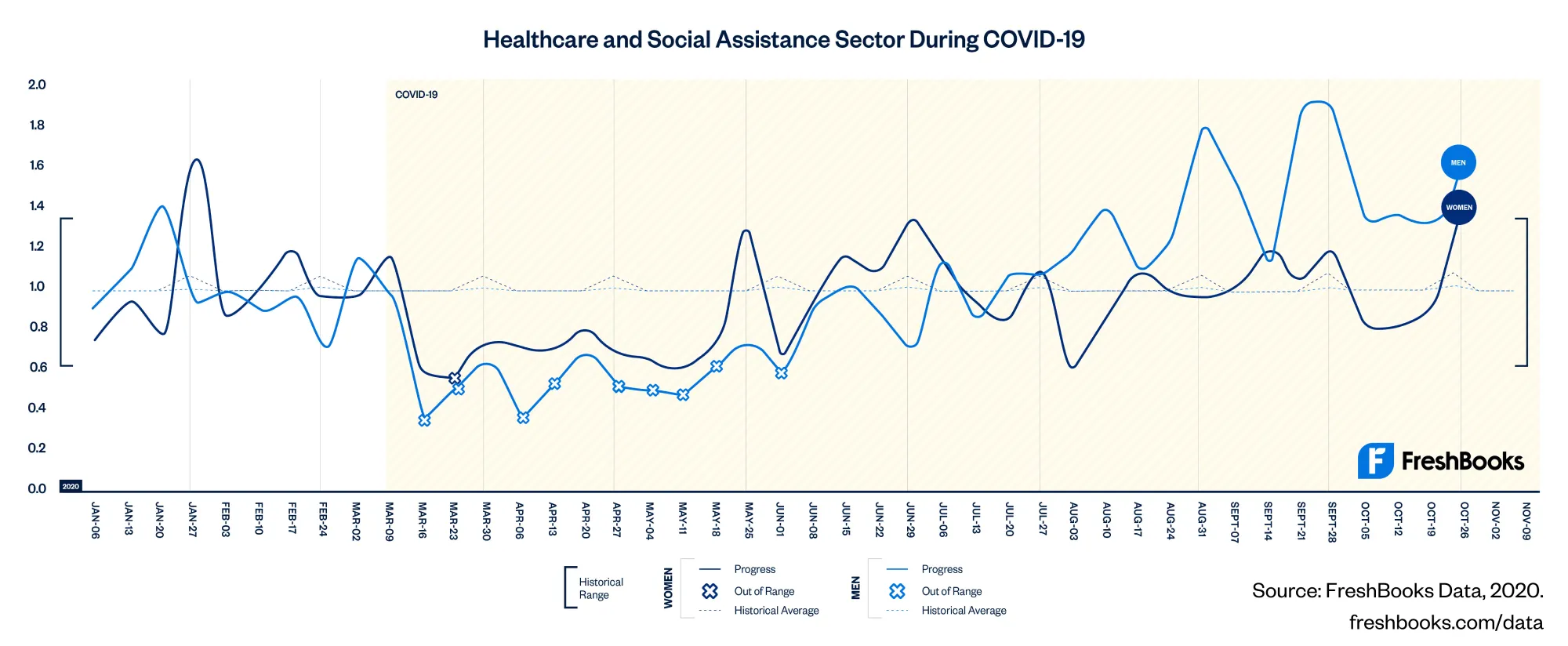

Normally considered a women-dominated industry, women-owned businesses in the healthcare and social assistance industry initially surpassed businesses owned by men during the pandemic. But when looking at the recovery of these businesses, it’s the men-owned businesses in this sector that have recovered quicker than ones led by women.

While businesses owned by men had a longer slow down than businesses owned by women, the increase in new clients quickly surpassed their historical range, and pre-COVID levels. In the case of women-owned businesses, the rate of new client additions stayed close or below the historical average, and have seen less of a recovery to levels seen prior to COVID-19.

There are many reasons why this could be happening. Based on a survey FreshBooks administered to 2,200 small business owners in the U.S., we know that women are more likely to care for children and the elderly, in some cases meaning they had to take time away from their business.

We also know that industries dominated by women, like education and healthcare, were among the first industries to be locked down when COVID-19 first hit, and will likely be some of the last to open. While it’s clear that most small businesses have been affected by COVID-19, the data outlining how Canadian women entrepreneurs are recovering is telling, and alerts us that more support needs to be in place to give everyone the chance of a consistent and quick financial recovery.

About the Study:

The Business Resiliency During COVID-19 study combines survey data from 2,200 FreshBooks U.S. customers with business data from over 10,000 small businesses in the United States and Canada. Survey responses were collected online between July and September 2020. The FreshBooks data science team examined a range of metrics (e.g., revenue, expenditures, invoice amounts) to infer the impact(s) of COVID-19 on overall business performance in aggregate as well as by gender and industry.

About FreshBooks:

FreshBooks is the #2 small business accounting software in America, with paying customers in 100+ countries. The company has helped more than 24million people process billions of dollars through its easy-to-use invoicing, time-tracking, expense management, and online payments features. Recognized with 10 Stevie awards for the best customer service in the world, the company’s mantra is to “execute extraordinary experiences everyday.” FreshBooks is headquartered in Toronto, Canada, with offices in Amsterdam, Netherlands, San Luis Potosi, Mexico, and Raleigh, North Carolina, USA. Learn more at www.FreshBooks.com

Are you a small business owner concerned about COVID-19?

We believe more than ever, people are looking to connect. It’s a particularly difficult time to be running your own business, so to bring people together, FreshBooks has launched #imakealiving, a Facebook community creating digital connections, so small business owners don’t have to feel alone.

We have a lineup of interesting business owners from all backgrounds (photographers, event planners, writers, agency owners, you name it…) who will be sharing their stories in the group. They’ll share how COVID-19 is impacting their business, what actions they’re taking right now, and advice they have for others in a similar boat. We’ll also be bringing business leaders into the community to share and teach new skills that may help business owners survive these uncertain times. You can join #imakealiving here.

If you’re looking for additional help or guidance, we’ve curated a helpful list of resources for small business owners across the U.S. and Canada. You can find the list of COVID-19 resources here.

Contact: Katey Townshend, pr@freshbooks.com

Share: