9 Best Payment Processing Companies in 2025

Payment processing companies provide essential software that allows you to accept payments for online and in-person transactions without having to set up your own secure system. The best payment processors enable you to accept a variety of payments like credit, debit, and ACH.

Choosing a good payment processor protects you and your customers. It also ensures you can enjoy a seamless checkout experience. We’ll explore the best credit card transaction processing companies to help you find the right choice for your small business.

Table of Contents

- FreshBooks Payments

- PayPal

- Square

- Shopify Payments

- Helcim

- Stax

- Chase Payment Solutions

- Payline

- Dharma Merchant Service

- How To Choose The Best Payment Processing System

- Best Credit Card Processing Companies

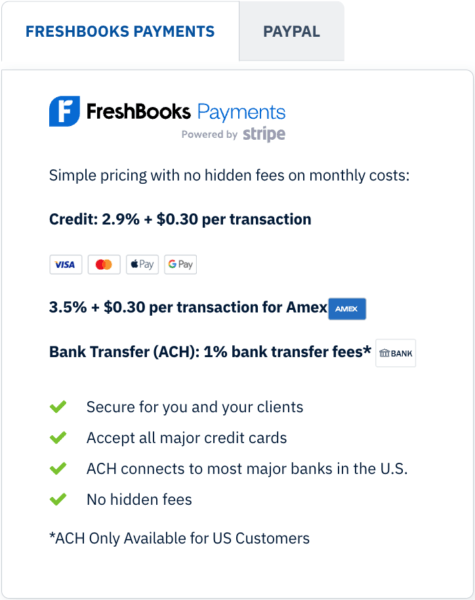

1. FreshBooks Payments

FreshBooks is the top pick for an overall payment processor that offers versatile payment solutions with plenty of apps and integrations. Accept major credit cards and ACH (Automated Clearing House) payments online at competitive rates and integrate with other systems like PayPal for even more payment methods.

FreshBooks also offers a variety of accounting features like easy estimates, invoicing, and expense tracking so you can manage all aspects of your business from one convenient system.

Features

- Automatically records payments

- Easily accept FreshBooks Payments online

- Integrate with other systems like PayPal

- Create custom checkout links for websites, emails, and social media

- Access to additional features like invoicing software and bookkeeping for a convenient, all-in-one accounting solution

- Transparent pricing solutions

Pricing

- Free 30-day trial

- 2.9% + $0.30 on credit card transactions

- 1% on ACH bank transfer fees

- Visit FreshBooks Pricing page for plan details

2. PayPal

As one of the biggest names in the market, PayPal feels familiar for many businesses and customers. In addition to the brand-name trust, it also offers a wide variety of integration and payment methods so customers can pay through links, QR codes, and other innovative systems. It syncs with a variety of shopping carts and platforms, making it easy to pair with most websites.

Features

- Wide variety of integration options

- Accepts payments through Venmo, QR codes, links, and more

- Accepts 25 currencies

Drawbacks

- Expensive processing for small sales

- Poor fit for high-risk merchants

- No free trial

Pricing

- No monthly fees

- Additional processing fees:

- 2.29% + $0.09 for in-person

- 2.89% + $0.49 for online

3. Square

Convenient and versatile, Square is a great fit for all-in-one retail payment processing. It’s one of the only processors to offer free point of sale (POS) with features like offline transactions and sales tracking. It also includes a free online store, making it popular for those setting up a new retail business. Square is fairly simple in its POS system that doesn’t offer many specialized features. It also doesn’t run on Windows devices, which may be a barrier for some businesses.

Features

- Free POS software

- Free accounting integrations

- Free mobile card reader

Drawbacks

- Incompatible with Windows

- Basic POS system without advanced features

Pricing

- No monthly fees

- Additional processing fees:

- 2.6% + $0.10 for in-person

- 2.9% + $0.30 for online

4. Shopify Payments

Shopify offers a quick and easy payment processing solution for online retailers. It features a POS system that syncs with Shopify Ecommerce, making it a great fit for those who already have a business set up with Shopify.

Features

- Syncs with Shopify E-commerce platform

- Compatible with a variety of payment methods

- Offers sales channels through Google, Instagram, and FaceBook

Drawbacks

- Caters primarily to retail businesses

- Does not include a free POS system

- Additional fees for using third-party gateways

Pricing

- $39 monthly fee

- Additional processing fees:

- 2.6% + $0.10 for in-person

- 2.9% + $0.30 for online

5. Helcim

Helcim’s low processing fees make it a great fit for businesses who conduct a high number of transactions. Their transparent pricing set-up features no monthly fees and a declining fee system where fees decrease as your transaction volume increases.

Features

- Quick set-up with fast approvals

- Strong customer support

- Automatic discounts based on volume

Drawbacks

- Does not offer same-day deposits

- Pricing structure not well suited to low transaction businesses

- May limit services for businesses in high-risk industries

Pricing

- No monthly fees

- Additional processing fees:

- 0.4% + $0.08 for in-person

- 0.5% + $0.25 for online

- Fees decline as you increase transaction volume

6. Stax

If your business conducts a high volume of sales or transactions, Stax can be a great fit. Its pricing scheme has a higher monthly fee structure than most, but it charges 0% on both in-person and online transactions, making it a great choice for businesses whose customers make large credit card purchases.

Features

- 24/7 customer support

- Offers a variety of add-ons

Drawbacks

- Not the most transparent pricing

- Add-ons like QuickBooks integration come at an extra fee

- Poor fit for businesses with low sales volume

Pricing

- No free trial

- $99.00 monthly fee for basic plan

- Additional processing fees:

- 0% + $0.08 for in-person

- 0% + $0.15 for online

7. Chase Payment Solutions

Chase Payment Solutions pairs perfectly with Chase Bank for a quick and easy deposit system. If you already have a merchant account with Chase or you’re looking to set up a business bank account, Chase gives you the option to use the same company for your payment processor and acquiring bank.

Features

- Convenient for making deposits

- High-quality POS technology

Drawbacks

- No free trial

- Doesn’t integrate with E-commerce systems

- Business banking account may come with extra fees

Pricing

- No monthly fees

- Additional processing fees:

- 2.6% + $0.10 for in-person

- 2.9% + $0.25 for online

8. Payline

Payline offers a secure, transparent system that’s a great fit for high-risk merchants. It accepts common payment methods and integrates with plenty of shopping carts and websites for a simple, effective payment processor. Its payment processing fees also are competitive, however, Payline charges 2 separate monthly fees for in-person and online transactions, which can add up quickly for businesses that conduct both types of transactions.

Features

- User-friendly system that’s great for new users

- Plenty of integrations including QuickBooks

- Accepts credit, debit, e-checks, and ACH

Drawbacks

- Monthly fees are separate for in-person and online transactions

Pricing

- $10 monthly fee for online, $20 monthly fee for in-person

- Additional processing fees:

- 0.4% + $0.10 for in-person

- 0.75% + $0.20 for online

9. Dharma Merchant Service

Dharma offers discounted monthly pricing for non-profits, making it a competitive choice for charities and similar businesses. However, even with the discount, its monthly fee system is better suited to businesses with a medium to high sales volume. Dharma is also a flexible payment processor that integrates with other POS systems so you’re not required to purchase unique hardware.

Features

- Integrates with a variety of POS hardware

- Transparent pricing

Drawbacks

- No free trial

- Poor fit for companies with lower sales volume

- May require both in-person and online accounts

Pricing

- $12 monthly fee for non-profits, $15 monthly fee for other businesses

- Additional processing fees:

- 0.15% + $0.08 for in-person

- 0.2% + $0.11 for online

How To Choose the Best Payment Processing System

When you’re looking for the best payment processing system, consider the following factors to find the right fit for your business needs.

User Interface

You and your customers will spend a lot of time interacting with your payment processors, so look for something that’s easy for everyone to use.

On the customer side, make sure the checkout experience is quick and straightforward so there are no barriers to online credit card payments.

On the business side, there are a variety of complexity levels to processing payments. Some are easy to use for new business owners and offer a simple but effective range of services. Others require some experience with coding, but may have more customization options.

Consider the demands of your business as well as your experience levels when choosing a new payment provider here.

Security

The Payment Card Industry Data Security Standard, or PCI DSS, is a measure for transaction security in payment processing. This covers things like cardholder data protection, network security, access controls, and data encryption, and is essential for both business and customer protection.

It’s a good idea to double-check that your payment processing company is PCI-compliant before signing up for any services. Many payment processors will offer PCI compliance for free so you can enjoy security at a competitive rate.

Integrations

You’re not just setting up a payment processor—you’re also setting up a system that will integrate with the rest of your business software. Seamless integration can be the difference between a clunky, frustrating user experience and a smooth checkout.

The best payment processor is one that can integrate with a wide variety of other software. If you already have an accounting system and a POS system, look for a processor that integrates with your existing systems. If you’re setting everything up for the first time, find a provider that offers enough integrations to support future growth as well as current needs.

FreshBooks integrates with over 100 apps to make for seamless connectivity. Browse the FreshBooks App Store to learn more about how integrations can support your small business.

On-Site or Off-Site Transactions

On-site payment gateways allow customers to complete the whole transaction without leaving the site while off-site gateways redirect customers to the payment gateway website to complete the purchase. While one isn’t necessarily better than the other, some people prefer on-site transactions since it feels more comfortable not to be navigated to a new website.

Pricing

There are a number of pricing elements to consider when selecting a payment processor: monthly fees, transaction fees, and additional fees. If you conduct a small volume of sales or transactions, then you may want to pick a payment service provider that offers free monthly services even if the transaction fees are slightly higher.

If you move a high volume of sales and transactions, flat monthly fees are less of a concern than transaction fees, so look for the provider with the lowest transaction costs.

FreshBooks pricing is transparent and straightforward so you can easily calculate costs for your small business payment processing.

Additional Features

As you expand your business, you might find that extra features can help you process payments more efficiently. This can include everything from innovative payment systems like QR codes and payment links to invoicing and subscriptions.

Check whether your potential payment processor offers any additional features and whether they’re included for free or at an extra charge. FreshBooks features include invoicing, expenses, estimates, time tracking, and more so you can manage all your business accounting from one easy hub.

Best Credit Card Processing Companies: Quick Overview

Take a quick look at the top credit and debit card payments payment processing companies with our comparison table. Browse free trials and top qualities to find the right fit for your business.

| Payment Processing Companies | Free Trial | Best For |

| FreshBooks Payments | Free 30-day trial | Small Business, Medium Size Business, Freelancers |

| PayPal | No free trial | E-commerce, Small Businesses |

| Square | 30 Days Trial | Retail Businesses |

| Shopify Payments | 3 Days Trial | Shopify E-commerce Users |

| Helcim | No free trial | Small Business, Medium Size Business |

| Stax | No free trial | Medium Business, Large Size Business |

| Chase Payment Solutions | No free trial | Established Business |

| Payline | Payline free trial | High-risk merchants |

| Dharma Merchant Service | 3 Days Trial | Non-profit Businesses |

Start Accepting Payments Online Now!

The right payment processing systems make it easy for you and your customers to conduct seamless business transactions. When you’re looking for the right credit card payments company, consider factors like integrations, ease of use, security, and competitive pricing.

FreshBooks payments makes it easy to accept online transactions at competitive rates. Process transactions from major credit cards and ACH then automatically record transactions and sync with your other FreshBooks systems for effortless invoicing and accounting. Try FreshBooks free today to discover how the right payment processor can support your small business.

Reviewed by

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

How to Accept Payments Online: 7 Ways in 2025

How to Accept Payments Online: 7 Ways in 2025 What Is eCash? Definition & Benefits

What Is eCash? Definition & Benefits What Is an Electronic Payment (E-Payment) System & How Does It Work?

What Is an Electronic Payment (E-Payment) System & How Does It Work? Stripe vs Moolah: A Detailed Comparison (Reviews & Pricing)

Stripe vs Moolah: A Detailed Comparison (Reviews & Pricing) Recurly Vs Stripe: What’s the Difference?

Recurly Vs Stripe: What’s the Difference? How to Print Receipts: 3 Steps

How to Print Receipts: 3 Steps