Construction Overhead Costs: How to Calculate it

Updated on November 30, 2020 | 14 min. read

🌟 KEY TAKEAWAYS

Overhead can be calculated by adding up your recurring expenses for the year and dividing by 12

Overhead can be categorized into two main groups – direct cost (job-based) and indirect cost (general)

Keeping track of your spending is one of the easiest ways to reduce overhead costs

Overhead costs should be added into estimates for each construction project to ensure profitability

Costs associated with production, staffing, supplies, and other essential elements can impact your bottom line. This is especially true when you start your own construction business and have a long list of overhead costs to manage each month.

Do you worry about having visibility into where your business is spending its money or about whether you’re set up to handle basic business requirements? If so, learning to calculate overhead could be one of the best decisions you make as a proprietor.

The good news is that you don’t need to feel intimidated when it comes to calculating overhead costs and making adjustments as needed.

Whether or not you consider yourself an accounting expert, there are many ways to reclaim or establish control of your business finances. This guide will explain everything you need to know about calculating overhead in your construction business.

Introduction to Overhead for Construction Businesses

Simply put, overhead is what you pay to keep your business running. You need to know your overhead costs to stay in control of your finances and spending. An easy way to calculate monthly overhead is to add up all of your day-to-day business expenses for a year and then divide by 12.

Some construction business owners might find themselves in a tough spot when it comes to calculating overhead. In a field like construction, it’s all too easy to lose track of the exact amounts a business spends on specific job costs, equipment repairs, budgets, bids, indirect expenses, direct expenses, and other miscellaneous business expenses.

Project and site managers might not even have access to specific numbers until after a contract or project has closed.

Unfortunately, the hard truth is that if you continually guess at your job costs, business expenses, and overhead, you’ll always be left with less revenue at the end of the day.

Although some numbers can shift and change based on a project’s results or duration, a commitment to good accounting principles at the core of your business should remain stable.

In terms of overhead in your construction business, this means that you should strive to:

- Learn the skills and tools needed to calculate totals correctly

- Accurately track and forecast business expenses for better long-term financial results

- Make changes and adapt when and if you discover problems with overspending

- Utilize outside or professional help when your business expenses are in limbo

What is Overhead in Construction?

Overhead is what you need to pay to “keep the lights on” for your construction business. You need to pay these daily or fixed monthly expenses to stay in business.

Overhead costs in construction can usually be divided up into two categories: Indirect and Direct Overhead Costs.

Types of Construction Costs and Expenses

The construction industry is unique in that the type of construction and construction projects can change drastically from job to job. Whether you are a general contractor or a specialized craftsperson, some costs and expenses repeat monthly or project to project.

These types of construction costs and expenses are often called indirect and direct overhead costs:

Indirect overhead costs are the day-to-day costs of running your business. Advertising, office rental, phone, insurance, utility bills, office supplies, and vehicle expenses all fall into the Indirect (or General) overhead costs category.

Direct overhead costs are those connected to a job or a project. These can include temporary rentals, rented toilets for the job site, utilities, fencing, or even temporary office space, water supplies or cooling stations for your employees. Direct overhead costs are also called “Project Specific Overhead” or “Job Overhead” costs.

Within construction companies, many expenses don’t fall into an official overhead category. This is because the term overhead traditionally refers to indirect costs that go towards keeping the business in operation without directly contributing to specific jobs or projects.

While these costs might take some time to identify, overhead is an especially important principle for industries like construction with greater needs for raw materials and hired labor.

To help make this easier to understand, here are a few key categories you should consider when learning how to calculate overhead in your construction business:

- Overhead Expenses: This category includes costs that impact the entire construction company from an administrative and legal standpoint. You should include things like rental space, employee benefits, insurance costs, marketing, legal fees, and recurring tax or property payments.

- Direct and Indirect Costs: The cost of materials per project varies greatly in construction. It also includes an indirect costs category for things extremely difficult to track per job site, like nails, wood scraps, and small building materials. These supplies aren’t the same as general overhead costs associated with running the business.

- Labor Costs: Labor and employee costs will vary based on the type of workers you hire. Some employees are year-round, while others may be contracted for specific jobs. Remember to make these distinctions as you factor up overhead for each job.

1. Create a Comprehensive List of Overhead Costs

When calculating your overhead costs, the best way is to develop an organizational system that flows into your general accounting procedures or software. This way, it’s harder to miss payments and receipts that could make a huge difference in factoring your costs.

Overhead costs in construction can include:

- Rent for office space and other facilities

- Benefits and salaries of full-time employees

- Insurance coverage for both people and equipment

- General liability coverage

- Transportation costs

- Labor hours

- Utilities like electricity, gas, and water

- Government fees and licenses

- Taxes on property, land, or other assets

- Depreciation costs

- Maintenance costs

- Other job costs

Depending on the specific type of construction your company handles, you may also have a separate category of manufacturing overhead costs. If you don’t produce any goods directly, this category may not apply.

2. Add Up Total Expenses

Once you have a complete and categorical list, it’s time to add everything. The best way to do this is to choose a set period of time (for instance, one month’s worth of overhead) and get your grand total.

The reason for choosing one standard period of time is this is the most commonly used time frame for business owners to look at financial reporting like an Income Statement. You will not have a good idea of your true overhead rate if you don’t account for all expenses or the bills have not been received. Accountants or bookkeepers tend to accrue recurring expenses at month-ends even if the bill has not been received and recorded yet.

3. Calculate Your Overhead Rate

The next step in the process is determining your overhead percentage rate. There are many ways to calculate the overhead rate. Some are calculated by the quantity of sales by project/product, the dollar value of sales by project, the number of employees in each project/job, total anticipated sales by project, etc. Using the dollar value of sales as an example, the math here is also relatively straightforward since you’ll be dividing the total you found in the second step by your monthly sales total.

The equation looks like this:

To get a percentage instead of a decimal after you first divide, multiply the result by 100. This will give you a percentage number that you can easily work with for a greater understanding of your business operations.

For example, if you have a 25% overhead rate, your company invests 25 cents in overhead for every dollar you make.

The appropriate overhead rate is industry-specific, so you should take some time to research what the standard is for businesses in your region. A good rule of thumb is 10% overhead with 10% profit.

4. Choose the Right Method for Allocating Overhead

If you want to get even more granular with calculating overhead in your business, you can begin to allocate certain categories of your overhead expenses.

In accounting, overhead allocation simply refers to the practice of distributing indirect costs to the projects/jobs or product lines and service lines you offer that generate revenue to ensure that you can report on profit and loss on a more granular level.

This practice generally provides more visibility than simply lumping all types of overhead together.

Overhead allocation depends on whether your construction company is focused on manufacturing, general contracting, land development, or other specialties. Typically, the more your business grows and spends, the greater your need for overhead allocation.

Depending on how you manage your accounting, you may receive different suggestions for allocation. Below are two of the most common ways to allocate overhead costs in this industry.

Rate of Direct Costs

This approach is appreciated for its simplicity because you will look at the costs of one job as a whole. Then, you’ll use a fairly standard percentage for determining how much overhead is needed to cover the job costs. This direct relationship relies on historical data and experience to guide future overhead decisions.

Proportion of Direct Job Costs

On the other hand, when you allocate overhead using a proportion of direct costs, you’re looking for accurate and exact numbers. If you have several jobs or contracts at once, this method divides the overhead amount evenly based on percentage.

Accounting professionals often prefer the proportional approach, as it allows for more accurate tracking of every dollar spent on overhead.

5. Double-check All Expenses and Costs

When managing overhead, it’s important to keep a pulse on how much money flows in and out. Failing to carefully monitor these costs can strain your business resources unnecessarily. Additionally, since overhead costs don’t usually generate income directly, they can hinder your growth and ability to invest in new projects.

Another important question to answer is: Who holds power regarding overhead cost decisions? Do multiple people within your organization have the ability to pay recurring bills or decide which fees are important? While it can be helpful to have administrative support, giving access to too many staff members can encourage your overhead to spiral out of control.

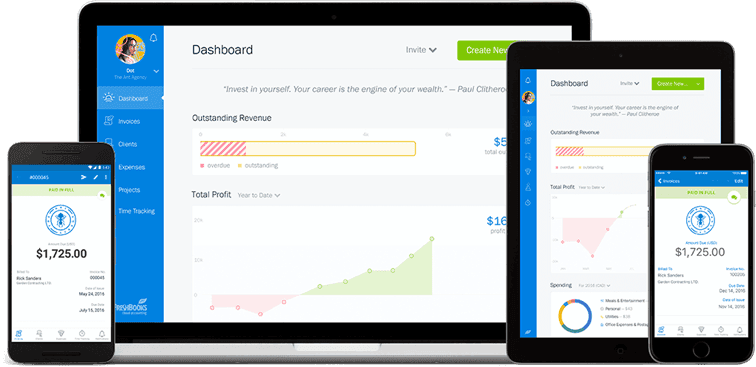

As a manager or owner, you must double-check the numbers carefully. This helps you reduce excess spending and avoid critical mistakes. A good tracking system can help you keep track of your business expenses throughout your company. FreshBooks expense and receipt tracking software can help you see the big picture and monitor your spending. Click here to give it a try.

6. Make Adjustments to Your Yearly Budget

Have you done all the math and realized that your overhead costs are too high? Remember, it’s never too late to make changes.

You can improve your financial situation by:

- Trimming excess overhead costs

- Taking a closer look at your profit margins

- Raising prices on goods and services as needed

- Developing more in-depth accounting procedures

You may need to combine multiple solutions to adjust your yearly budget in a way that’s not only practical but also encourages a positive financial trend.

Options for Managing Construction Overhead

Now that you understand how to calculate your business's overhead percentages, it may be time to consider a different approach.

To get a better handle on overhead management, you can take one of several approaches, or a combination of the following.

- The DIY approach: If bookkeeping and tracking is your strong suit, consider a do-it-yourself method for tracking overhead. This provides the greatest transparency, as you’ll need to be extremely hands-on in monitoring recurring overhead. Unfortunately, it might also be taxing on your personal time commitments.

- The tech-based solution: When you choose a cloud-based accounting software like FreshBooks, you can eliminate much of the stress involved with manual tracking. Platforms like FreshBooks are uniquely designed for industries like construction, which require much of your management time to be spent elsewhere. Click here to start your free trial.

- An external finance professional: If you hire an outside consultant, accountant, or tax professional, it can make a huge difference in your business structure. Although this option has a bigger price tag, you may reap dividends by saving valuable time, money, and effort.

Mistakes to Avoid in Construction Overhead

Despite your best efforts, there are times when you’ll run the risk of making a mistake with your overhead. During these moments, keep an open mind, and be willing to seek financial help.

To help you avoid some common pitfalls that construction business owners encounter in this area, we’ve provided a list of common mistakes in construction accounting:

- You allocate overhead incorrectly: As mentioned previously, there are a few different categories to consider for construction overhead. Sometimes, construction businesses try to allocate overhead costs like rent, utilities, and insurance to a specific job only. This misrepresents how overhead percentages can affect the entire company, and in turn, it will result in erroneous reporting.

- You go through lulls in tracking: Once you’ve developed an expense tracking system, stick with it. No matter how busy your construction business gets or how many new jobs you take, you can’t afford to lose sight of vital financial data. If you find it hard to track overhead during certain times of the year, consider outsourcing this aspect of your bookkeeping for a set amount of time.

- You don’t get back on track financially: If your overhead calculations don’t reveal what you’d like them to about the longevity of your business, remember that future is in your hands. Make adjustments and tweak your business model, but don’t give up. Succumbing to poor overhead management will harm your company’s financial future.

How To Reduce Your Overhead Costs

It seems simple, but you can reduce your overhead costs by looking at your current expenses and seeing where you can cut costs. If you have administrative personnel or employees making purchases for you, explain the importance of cost savings to them. Keeping careful track of your spending can help your business reduce overhead costs in the long run.

The Bottom Line for Construction Businesses

When you want to see your business become successful, you must be willing to dive deep into the practices and habits that encourage business growth.

By learning the ins and outs of your own business overhead, you’ll not only be able to answer for every dollar your business spends, but you’ll be better equipped to make long-term decisions that affect you and your employees.

Always remember to come back to the basics. Start with listing your exact job costs, complete a few simple math steps to determine totals and percentages, double-check everything, and make adjustments as needed. The entire process can be as simple or as complex as you need it for your unique organization.

The ability to establish a thriving business is always available to you, no matter how long you’ve been in business. When you invest time in the right strategies and tools, you can chart a new path forward in your entrepreneurial journey.

If you want to simplify your construction company's finances. Check out our guide on the Best Construction Accounting Software for easy-to-use solutions that can help you manage your projects and expenses effortlessly.

Conclusion

It’s important not to overlook the day-to-day expenses associated with running a business. Overhead costs can sneak up on you! It’s important to know your overhead costs and adjust them if you or your employees spend too much.

Adding your overhead costs and forecasting accordingly can turn a possible money-losing project into a profitable job. You can calculate indirect overhead costs by adding your recurring monthly expenses. Think of overhead as the costs of keeping a roof over your company’s head. When you realize that it’s part of the long-term success of your business, it becomes a solid plan you can build on.

FAQs on Construction Overhead Costs

What is the 20% overhead charge?

The 20% overhead charge means a construction company spends 20% of its revenue on a build. A lower overhead percentage rate means more profits for the company and that the company has been more efficient and cost-effective.

What are overhead costs examples?

Some examples of overhead costs are utility bills, office rentals, wages, and insurance. Overhead costs are anything that relates to the cost of operating the business but are not direct costs like those that pertain to creating a product or service.

What are 4 types of overhead?

The 4 simple types of overhead are production overhead, administrative overhead, selling overhead, and distribution overhead. There are more, however, like insurance, bonding premiums, vehicle and equipment expenses, and more. The list can go on and differs from company to company.

What is a good percentage of overhead costs?

The lower the percentage of overhead, the better for the business overall because that means more profits. The average overhead costs for construction sit around 10%, but this can vary depending on the project and its scope. The larger the project, the higher the overhead, and the smaller, the lower — on average.

Does overhead include payroll?

Yes, overhead does include payroll. This is called an indirect overhead expense. Things like salaries and payroll fall into this category and are considered fixed expenses. Fixed overhead expenses stay the same month to month and generally don’t change with business activities.