Tax Shield: Definition, Formula & Examples

Who doesn’t like being able to pay less taxes? There are all sorts of opportunities to help reduce the total tax amount you owe when submitting tax filings. But, where should you start? Where do you look first? A tax shield is a great way to help with this.

You have a little bit of flexibility with a tax shield since you have an opportunity to reduce taxable income for a specific tax year. Alternatively, you have the opportunity to move it forward to a future point in time.

We put together this article to help cover what you need to know. Keep reading to learn all about a tax shield, how to calculate it depending on your effective tax rate, and a few examples.

Table of Contents

KEY TAKEAWAYS

- A tax shield is a legal strategy to help reduce the amount of taxes owed on taxable income.

- Both individual taxpayers and corporations can use a tax shield.

- Tax shields work through claiming eligible deductions. These can include medical expenses, mortgage interest, amortization, depreciation, and charitable donations.

What Is a Tax Shield?

A tax shield is a way that you can reduce the total amount of taxes owed on your federal tax return. It’s an allowable deduction that you can take from your taxable income. Tax shields can vary slightly depending on where you’re located, as some countries have different rules.

Both individuals and corporations are eligible to use a tax shield to reduce their taxable income. This happens through claiming deductions such as medical expenses, mortgage interest, charitable donations, depreciation, and amortization. Taxpayers can either reduce their taxable income for a specific year or choose to defer their income taxes to some point in the future.

What Is the Formula for Calculating Tax Shield?

The good news is that calculating a tax shield can be fairly straightforward to do as long as you have the right information. You will need to know your individual tax rate as well as the amount of all your tax-deductible expenses.

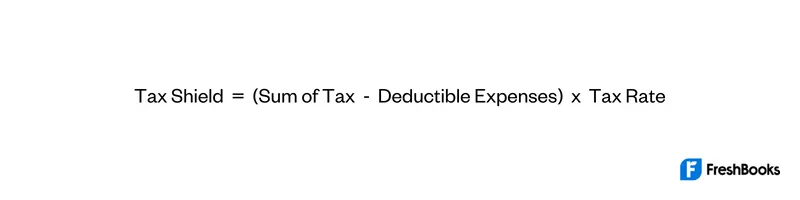

The formula to calculate a tax shield would look like this:

For example, if you have a tax rate of 24 percent and you have $2,000 in mortgage interest, you can determine that your tax shield would be $480.

How Tax Shields Work

It was mentioned above, but both individuals and corporations can take advantage of the benefits of tax shields. However, there are two primary strategies that a company might choose from for their tax shield: capital structure optimization and accelerated depreciation methods.

Since adding or removing a tax shield can be significant, many companies consider this when exploring an optimal capital structure. An optimal capital structure is a good mix of both debt and equity funding that reduces a company’s cost of capital and increases its market value.

Interest expenses on certain debts can be tax-deductible, which can make the entire process of debt funding much easier and cheaper for a business. This works in the opposite way to dividend payments, which are not tax-deductible.

Accelerated depreciation is a method of depreciation that allows companies to depreciate capital assets faster early in their useful life resulting in greater depreciation expenses in the first few years and lower later on. It is one of the largest tax benefits corporations can get.

How Is Tax Shield Interest Calculated?

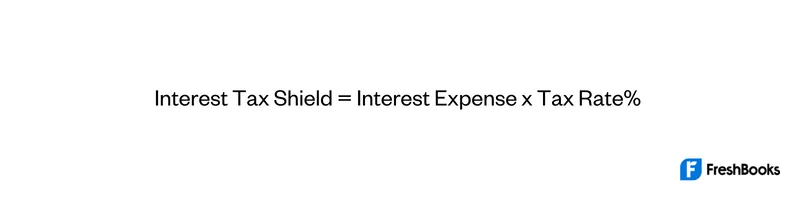

The interest tax shield has to do with the tax savings you can receive from deducting various interest expenses on debt. The payment of the interest expense is going to ultimately lower the taxable income and the total amount of taxes that are actually due.

To calculate tax shield interest, you need to know your tax rate percentage and your interest expenses. The formula would look like this:

Tax Shield vs Tax Evasion

A tax shield is a legal way for individual taxpayers and corporations to try and reduce their taxable income. Essentially, it’s a way to reduce the taxes that you owe. The total value of a tax shield is going to depend on the tax rate of an individual or corporation and their tax-deductible expenses.

Tax evasion, on the other hand, is an illegal practice. Tax evasion occurs when people intentionally fail to report their revenue or income to the proper taxing authority, such as the Internal Revenue Service (IRS).

If you don’t report every element of your income—including bonuses paid by your employer and tips—then you are guilty of tax evasion. If you deliberately claim specific tax credits that you’re not eligible for, then you are committing tax fraud.

Tax evasion can also occur if an individual simply does not file their taxes at all. There can be significant fines and even jail time for tax evasion. It is a serious offense.

Examples of Tax Shield

There are many examples of a tax shield, and it often depends on the tax rate of the corporation or individual as well as their tax-deductible expenses. It can also depend on the type of taxable expenses being used as a tax shield.

For example, let’s say that you pay a charitable contribution. You can then decide to deduct the contribution as a taxable expense. Using contributions as a tax shield is a common strategy and tool used by governments to support nonprofit institutions.

Another example would be incurring various medical expenses. You can deduct some of these expenses as taxable expenses. This allows you to reduce your total tax burden. Lower-income taxpayers can benefit significantly from this if they incur larger medical expenditures.

Summary

A tax shield is a way for individual taxpayers and corporations to reduce their taxable income. This happens through claiming allowable deductions like medical expenses, charitable donations, or mortgage interest. A corporation might claim depreciation and amortization.

A tax shield will allow a taxpayer to reduce their taxable income or defer their income taxes to a time in the future. To calculate a tax shield, you need to know the value of your tax-deductible expenses and your own individual tax rate.

FAQs About Tax Shield

Corporations use tax shields strategically to receive tax benefits. They often do this in one of two ways, either through capital structure optimization or accelerated depreciation methods.

The simple answer is yes. However, it can be a bit more complicated than that. Implementing an effective tax shield strategy can help increase the total value of a business since it lowers tax liability.

The benefit of using depreciation with a tax shield is that you can subtract any depreciation expenses from taxable income. These intangible assets can affect your rate of tax and tax expense.

A tax shield in capital budgeting is a way for corporations to strategically plan their optimal capital structure and decide which investments to follow. This, in turn, makes debt funding much cheaper since interest expenses on debt are tax-deductible.

Share: