Tax Loss Carryforward (TLC): Definition, Overview & Example

Taxes can be a confusing time for any individual or business. With so many rules and regulations, it can be tricky to wrap your head around every single one of them.

One method that taxpayers can take advantage of is a tax loss carry-forward (TLC).

But what exactly is a TLC? And how can it be used to offset your taxable income? Find out by reading the article below.

Table of Contents

KEY TAKEAWAYS

- A TLC is a method that taxpayers can use to reduce their tax liability.

- It works by using a taxable loss in excess of gains in a given year and carrying it forward.

- Any capital losses that exceed a year’s worth of capital gains can be used to offset ordinary taxable income. This is up to $3,000 in any future tax year.

- This can be done for an indefinite period until it has been exhausted.

- Net operating losses (NOLS) are losses that are incurred in business pursuits.

- These can be carried forward indefinitely as a result of the TCJA.

What Is A Tax Loss Carry-forward?

A TLC is a provision that enables a taxpayer to carry over a tax loss to balance a gain in future taxes. A person or a company can use the TLC to lower any upcoming tax obligations.

Capital losses in excess of $3,000 generate a capital loss carry-forward. These can be used in future tax years. Any investors that use these capital loss tax provisions can reduce the effect of investment losses and minimize their tax impact.

What Is The Purpose Of A Tax Loss Carry-forward?

The purpose of TLCs are particularly beneficial since they give businesses future tax reductions. State regulations governing the use of TLCs differ, but typically a carry-forward from the previous two or three years can be used for a subsequent time period of seven years. The carry-forwards then become inactive.

TLCs are attractive assets in and of themselves. In fact, businesses occasionally acquire rival firms just to use the tax losses as carry-forwards.

How Does A Tax Loss Carry-forward Work?

In terms of taxes, think of a TLC as the opposite of profit, or a negative profit. When the cost basis outweighs revenues or capital losses outweigh capital gains, a negative profit is produced. This clause is a fantastic instrument when creating future tax relief.

Net operating loss (NOL) carry-forwards and capital loss carry-forwards are the two primary categories of loss carry-forwards.

How Is a Tax Loss Carry-forward Calculated?

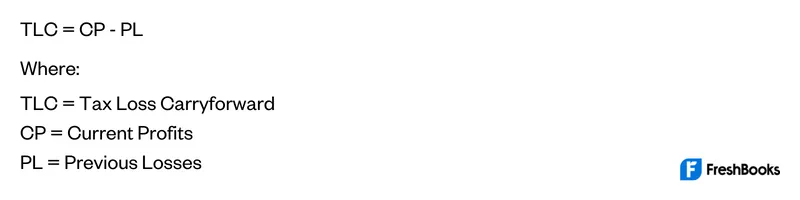

Tax loss carry-forward can be calculated using the following formula:

How Long Can Losses Be Carried Forward?

Any capital losses experienced by a business that exceed its capital gains in a year may be used to offset ordinary income.

The rules surrounding how long the losses can be carried forward will differ depending on what state you are in. But the general rule is that they can be used for the next seven years or until the balance has been exhausted.

For any stock that is held for more than a year, the holding period is typically classed as long-term.

How To Claim A Tax Loss Carry-forward

TLCs aren’t claimed in the same way you would claim a tax credit. Instead, they can be used to offset ordinary income. Let’s say you have a tax loss of $30,000 from the previous year but a current profit of $90,000. You can take the $30,000 away from your $90,000 and only be taxed on the remaining $60,000.

What Are The Limitations Of A Tax Loss Carry-forward?

The IRS enabled corporations to carry NOLs forward for 20 years to net against future earnings or backward for two years. This allowed businesses to receive an instant refund of previously paid taxes prior to the implementation of the Tax Cuts and Jobs Act (TCJA) in 2018. Any unclaimed business losses that remained unclaimed after 20 years expired and could no longer be deducted from taxable income.

Except for certain farming losses and non-life insurance companies, the TCJA eliminated the two-year carryback provision for tax years beginning on or after January 1, 2018. However, the clause now permits an endless carry-forward time. The carry-forwards are currently restricted to 80% of the net income from each succeeding year. The previous tax laws continue to apply to business losses that started in tax years that began before Jan. 1, 2018. Any lingering losses will continue to expire after 20 years.

According to the TCJA regulations, farming losses may be carried forward indefinitely or back two years for an immediate return of earlier taxes paid. Essentially, non-life insurance providers are continuing to operate under pre-TCJA rules and regulations. This is because the 80% cap on carrying back two years or carrying forward 20 years does not apply to them.

Example of Tax Loss Carry-forward

Here’s an example of an NOL carry-forward rule post-TCJA. Let’s say that Company X loses $10 million in 2021, and earns $12 million in 2022. The carryover limit of 80% of $12 million in 2022 is $9.6 million. The NOL carry-forward lowers the taxable income in 2022 to $2.4 million. This is the $12 million 2022 income – $9.6 million allowable NOL carry-forward.

The calculation of the company’s deferred tax asset includes the $400,000 NOL carry-forward which could be used after 2022. This is the $10 million total NOL – $9.6 million used NOL carry-forward.

Summary

TLCs allow taxpayers to carry forward tax losses from previous years to offset the amount of tax that they have to pay in subsequent years.

When calculating and implementing tax loss carry-forwards, it is best to consult the IRS or a licensed tax professional. This is because there are regulations and exceptions for practically every situation, so the situation for your business may vastly differ from someone else’s business.

FAQS on Tax Loss Carry-forward

Any business or taxpayer that is subject to income taxes can use a TLC. It can be used to balance out their long-term gains with their long-term losses.

A portion of your capital losses may be carried over to your current tax return if you have greater capital losses than gains in prior years. Look at line 15 of Schedule D on your previous tax return. If Schedule D line 15 is negative, you could be able to roll over a capital loss to the current year.

Carryover can be defined as taking a pre-existing tax loss amount and “carrying it over” to the current tax year. This can also be described as a carry-forward with the same basic principle.

Let’s say that you had a tax loss of $3,000 in your last year of tax. In your current relevant tax period, you have a profit of $2,000. You can use some of your previous business tax losses to offset your current business profits or future profits and reduce your tax liability. Any money that is left over can be used for subsequent years for federal income tax purposes.

Share: