QSEHRA Explained (Qualified Small Employer Health Reimbursement Arrangement)

Most employees are looking for employer-provided health insurance. However, small businesses are not always able to offer health insurance plans.

In 2017, a plan emerged. It was to help small businesses offer tax-deductible healthcare reimbursemen+ts to their employees. Known as a QSEHRA, it helps offset health insurance coverage and pay for any uncovered medical expenses.

This guide gives a comprehensive overview of a QSEHRA. We’ll go over how it works, who is eligible, and the pros and cons. To start, what exactly is a QSEHRA?

Table of Contents

KEY TAKEAWAYS

- A QSEHRA is a plan offered by small business employers.

- It is a healthcare subsidy plan.

- The costs are tax-deductible by businesses.

- They are also tax-free for employees.

What Is a QSEHRA?

A qualified small employer health reimbursement arrangement (QSEHRA) is a healthcare subsidy plan. It allows businesses with under 50 employees who work full time to help cover any healthcare and medical expenses.

A QSEHRA covers personal health insurance policy costs and qualified medical expenses. These include doctor visits and prescription drugs.

All QSEHRA reimbursements are tax-free for both employers and employees. However, there is a cap on the amount of reimbursed eligible expenses. For employees with no dependents, the limit is $5,450. For employees with families, the limit is $11,050.

This plan offers greater flexibility and efficiency than a group health insurance plan. For employers, it removes the hassle associated with managing group plans and offers payroll tax incentives. Employees are free to choose the individual coverage they want from the individual market. They can then claim tax-deductible medical expenses.

What Is the History of the Qualified Small Employer Health Reimbursement Arrangement?

On December 13th, 2016, former President of the United States Barack Obama made QSEHRA a lawful act by signing it in. It was an important part of what was known as the 21st Century Cures Act. Once the plans were in place, they became available to employees on March 13, 2017.

Between 2014 and 2016, the act helped correct problems for small businesses. These were businesses that were offering health reimbursement arrangements. During the previously mentioned period, small businesses could be charged with a penalty of $100 per employee per day. This would be charged if they were out of compliance with the requirements of the Affordable Care Act.

The Affordable Care Act

The Affordable Care Act (ACA) is a comprehensive reform of healthcare. President Barack Obama signed it into law in March 2010.

It was formerly known as the Patient Protection and Affordable Care Act. But it was more casually known as Obamacare.

The law had a list of each health policy that was meant to expand access to health insurance. The aim of this was to help provide affordable individual health insurance policies. This was to the millions of Americans who were uninsured.

The ACA expanded Medicaid eligibility. It also created health insurance exchanges as well as mentioned that Americans obtain health insurance. It stopped insurance companies denying coverage or charging more due to pre-existing conditions.

It also allowed children to extend the time that they could remain on their parent’s insurance plan. The age limit was extended to 26 years old.

How Does a QSEHRA Work?

One of the aims of QSEHRA was to make it easy and straightforward to follow. To put it very simply, employees pay for their own healthcare and expenses. You as a business owner would then reimburse them for the costs.

For a more in-depth view as a QSEHRA eligible employer, the process is as follows.

1. The employer sets the reimbursement limit

There are no minimum contribution rules. An eligible employer can offer the allowance limit of their choice. The contribution limit for 2022 is $5,450 per year for single employees with no dependents. For families, the limit is $11,050 per year.

2. Employees make their purchases

Employees are free to choose the health coverage plan that best fits their needs. Expenses that are eligible for reimbursement include

- Copays

- Deductibles

- Prescription drugs

- Individual health insurance premiums

- Individual vision, dental, or long-term care premiums

- Chiropractor visits

- And more

3. Employees submit their proof of expenses

After an employee pays for a qualified expense, they submit their receipts to their employer. Companies can either self-administer their QSEHRA or outsource to a third-party administrator.

Proof of expense documentation should include

- A product or service description

- Total expense cost

- Date

- Doctor’s note or prescription

4. The employer reviews and reimburses expenses

Once the proper documentation is submitted, the employer reviews and approves the reimbursement. Amounts can be reimbursed up to the accrued monthly allowance.

All QSEHRA reimbursements are tax-free for both the employer and the employee. However, this doesn’t apply to employees without health insurance or ineligible health insurance. Those employees must report any reimbursements as taxable income.

Who Is Eligible for a QSEHRA?

Let’s break down the eligibility requirements for employers and employees in a QSEHRA.

Employer Requirements

To be eligible for a QSEHRA, an employer:

- Can’t offer a group health insurance plan simultaneously

- Must have fewer than 50 employees

- Must provide the same terms and benefits to all employees

- Must give at least 90 days’ notice to employees before the beginning of the year

Employee Requirements

To be eligible for a QSEHRA, an employee must have health insurance that meets the following requirements.

- An individual healthcare plan purchased through the ACA marketplace or an insurance company

- A spouse or parent’s insurance if the employee is under the age of 26

- Government-sponsored insurance like Medicare or Medicaid

How to Keep in Compliance With QSEHRA

All employees that are covered by a QSEHRA must be able to provide an equal benefit to employees for it to comply with the law. This means that the employer’s contributions to each of their employees must be equal.

However, employees aren’t required to include any new employees who haven’t hit the 90-day requirement or part-time employees. As well as any seasonal employees or seasonal workers in their provided benefits.

If an employer offers a QSEHRA to an employee, they must offer it to all full-time employees. The ACA governs these arrangements. It is required by the ACA that any participating employee must provide some proof of coverage. This is that they have the minimum essential healthcare coverage required.

Employers must also give employees a summary plan description. This plan must fully describe their plan’s benefits. This is because QSEHRA is overseen by the Employee Retirement Income Security Act (ERISA).

The final key point of compliance is different health insurance. If an employer makes another form of group health insurance available, they no longer are permitted to offer a QSEHRA plan.

QSEHRA Contributions

Small business employers can decide what they’ll contribute to the healthcare costs of their employees. This is up to an annual maximum that the IRS sets.

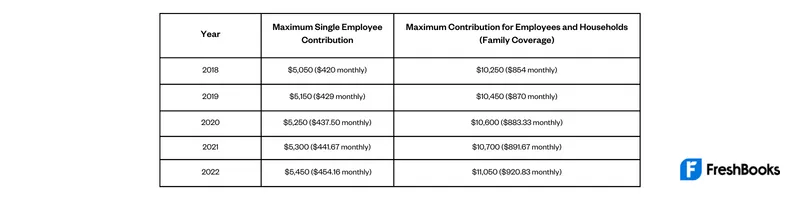

Here is a table of the maximum limits of a QSEHRA throughout the years:

The amount that you provide your employees with will affect the amount of premium tax credit that your employees are eligible to receive. This is with their marketplace coverage. This goes the same for if you provide the QSEHRA to the employees’ dependents.

Depending on the QSEHRA amount you provide, they may be eligible for some or no premium tax credit.

What Are the Benefits of a QSEHRA?

There are several advantages to a QSEHRA, including

More Options

Small business owners often choose a group plan because they can’t afford comprehensive health care coverage. A QSEHRA gives employees the freedom to choose their health care plan. It even allows them to be reimbursed for different costs, such as prescription drugs or dentist appointments.

Tax Incentives

A QSEHRA is tax-deductible for both employers and employees. Therefore, eligible employers don’t need to pay payroll taxes to make reimbursements. And employees don’t have to pay income tax on reimbursements either. In addition, companies can claim reimbursements as tax deductibles.

Flexibility

A QSEHRA gives employers more control over the type of expenses they’ll reimburse and how much reimbursements to give employees. Unlike group health care plans, there are no required minimum contributions for a QSEHRA.

Predictable Costs

Employers will no longer be surprised by unexpected expenses. A QSEHRA allows employers to set monthly reimbursement limits.

Location Agnostic

A QSEHRA doesn’t distinguish between employees who work in-state or out-of-state. Both can be covered without any administrative or financial issues.

Attracts Employees

Many employees value the flexibility of a QSEHRA. Health benefits are one of the top considerations for job applicants, so this presents a significant advantage.

What Are the Drawbacks of a QSEHRA?

Despite the many advantages, a QSEHRA can still have some drawbacks. These include:

Limited Contribution

A QSEHRA limits the number of reimbursements an employer can offer their employees. For employees with no dependents, the limit is $5,300. For employees with families, the limit is $10,700.

Complex Administrative Requirements

Small business owners may find it challenging to manage a QSEHRA by themselves. To avoid fines, many companies end up hiring a QSEHRA administrator. This is an

expense to consider when deciding whether to offer a QSEHRA.

Learning Curve

QSEHRA has only been around since 2017. So, many people are still unaware of the plan and how it works. As a result, businesses may need to spend extra time and effort educating their employees about the pros and cons of this plan.

How Do You Set Up a QSEHRA?

There are 4 simple steps to setting up a QSEHRA.

1. Design a plan

When designing a plan, think about the terms and reimbursement rules your company will enforce. What allowance limit will you set? Will you cover only premiums, or both premiums and medical costs? Go through the instructions provided by the IRS.

2. Issue documentation

To set up a QSEHRA, you’re legally required to issue certain documents. This includes an explanation and details of your plan coverage. You should also explain the details of the plan to your employees.

3. Set up a QSEHRA administration process

In order to be reimbursed, employees have to provide a form of proof of their healthcare costs. However, it’s illegal for employers to request employee medical records. That’s why many small businesses work with a third-party QSEHRA administrator. Not only does this ensure your business remains compliant with the law, but it also saves time and effort.

4. Choose a start date

You can start your QSEHRA at any time. Generally, it’s easier to begin at the start of the year. If you’re already providing traditional group health insurance, then you’ll need to wait. This is until that coverage expires before launching your QSEHRA.

Summary

QSEHRA is a relatively new option that offers greater flexibility for employers and employees alike. It helps to provide employees with health insurance and make sure that they can afford health care costs and health expenses.

Just remember to choose a professional third-party QSEHRA administrator. They will help you keep track of documents and provide legal advice.

FAQs on QSEHRA

To qualify, an employer must have fewer than 50 employees who work full-time. They must also provide the same arrangement to all of their employees. However, reimbursement amounts may vary based on age and family size. Lastly, an employer can’t offer a group health plan and QSEHRA simultaneously.

Besides a QSEHRA, there are several other options. Small businesses of under 50 employees can also offer the Small Business Health Options Program (SHOP). They can also provide an integrated HRA or participate in a health insurance purchasing co-op.

Generally, yes. However, S Corporation owners with greater than 2% ownership are ineligible.

There is no contribution to health reimbursement arrangements from employees. Any eligible employee can therefore not opt-out of a QSEHRA plan that has been provided by their employer.

Yes, they can. Any dental and/or vision premiums and expenses put through a QSEHRA can be reimbursed. Although it’s important to note that an employee must have medical insurance first. This insurance has to qualify as minimum essential coverage. If it doesn’t qualify, then it cannot participate in the QSEHRA.

Share: