Year-Over-Year (YOY) Definition, Formula & Calculation

There are several important financial comparisons that you can benefit from in business. Understanding where your financials stand and how they’re being used can offer valuable insights.

Year-over-year is a type of financial comparison that can be handy to know. So how exactly does it work and what do you need to know? Keep reading our guide to find out, including a formula!

Table of Contents

KEY TAKEAWAYS

- Year-over-year (YOY) is a financial comparison to evaluate two or more events.

- YOY is a great way to calculate and evaluate the performance of a company over time.

- There can be different financial metrics and economic indicators that can get evaluated.

What Is Year-Over-Year (YOY)?

Year-over-year (YOY) is used as a financial comparison to look into certain events on an annual basis. Looking into YOY helps to find out more information about your business’s financial performance.

You can gain insights into whether or not financials are getting better, staying the same, or getting worse. It works by comparing data from a specific time period to the year prior. It’s useful information that allows you to see insights based on a whole year, not just weekly or monthly.

YOY can also get used for any type of data, including financial metrics and economic indicators.

Benefits of YOY Calculations

Financial comparisons will offer any number of benefits depending on what you’re looking for. Here are some of the main benefits of YOY calculations:

- Identify new trends

By comparing data from one year to the next, analysts can identify trends and patterns that might otherwise go unseen. This can be helpful in certain industries that see regular change, such as technology.

- Seasonality

Many economic indicators exhibit certain patterns over time. YOY calculations can aid in identifying these patterns and you gain insights into underlying trends.

- Performance evaluation

YOY calculations can be used to evaluate a company’s performance over time. This can help make comparisons and assess the progress of your business.

Why Should You Use YOY Calculations?

Being able to gain insights into the financial performance of your business will always come in handy. YOY calculations will help identify trends, better understand seasonality and evaluate business performance. Having all of this information will allow you to make more informed business decisions.

A public company will show a lot of importance towards YOY calculations. This is since these business types must disclose financial information to shareholders. Plus, investors use this information to better understand the financial health of a company.

Common YOY Financial Metrics and Economic Indicators

There are many financial metrics and economic indicators that YOY calculations can evaluate.

Some of the most common financial metrics include:

- Revenue: YOY revenue growth gets used to measure a company’s success in increasing sales.

- Profit: This gets used to measure a company’s ability to increase its bottom line.

- Earnings per share (EPS): This financial metric gets used to measure the increase in earnings for shareholders.

- Asset turnover: This relates to how well and efficiently a company uses its assets.

Some of the most common economic indicators include:

- GDP to measure the economic health of a company

- Inflation to measure the rate of price increases

- Unemployment rate to measure the changes in the job market

- Consumer prices to measure the overall rate of inflation

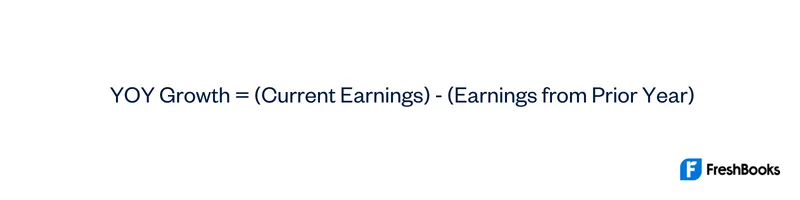

How to Calculate YOY

Calculating YOY will provide you with actionable insights into the financial health of your business. And the good news is it’s fairly straightforward to calculate.

Let’s say that you wanted to gain insights into the fourth quarter of the previous year. Once you have the fourth-quarter earnings from the current year, you subtract them from the prior year’s earnings.

When the result is positive it means your business experienced growth. On the flip side, if the result is negative then you’ve experienced a loss.

Summary

Understanding how to use accurate comparisons for financials will bring several benefits. YOY calculations help look into and find information about the financial performance of your business. Essentially, it allows you to get a better sense of business growth and cash flow growth.

This information will allow you to gain insights into how your finances are performing. It will allow you to determine if they’re getting better, staying the same, or getting worse. To find the comparison over time, you compare the data from a specific year against the year prior.

Frequently Asked Questions

YOY compares a specific year against the prior year. Month-over-month does the same thing but on a monthly basis and would determine your monthly growth rate.

YOY considers changes within a 12-month time period. Year to date (YTD) considers changes that are relative to the beginning of the year.

This is a key performance indicator that compares the growth of one period against the same period that happened one year prior. It’s a great way to understand the pace of growth and economic growth.

Share: