Weighted Average: Definition, Formula & How to Calculate

There are a number of things to consider when looking into the numbers of your business.

But when it comes to your finances, you want to be as accurate as possible to avoid any mistakes and miscalculations being made.

The weighted average allows for a more accurate result than a simple average calculation. But what exactly is the weighted average, and how can you calculate it?

Read on as we take a closer look in our in-depth guide on the weighted average.

Table of Contents

KEY TAKEAWAYS

- The weighted average takes into account the importance and frequency of relative factors within a data set.

- It is a more accurate method than using a simple average calculation.

- The weighted average can be used by stock investors to track the cost basis of shares bought and sold at different times.

What Is a Weighted Average?

A weighted average is an analysis that accounts for the various levels of significance of the numbers in a data collection. Each number in the data set is multiplied by a predefined weight before the final calculation is completed. This method is known to be more accurate than using the traditional simple average. This is because the simple average works by assigning each number in the data set an identical weight. Whereas the weighted average goes into more detail.

How to Calculate Weighted Average

Finding the weighted average is different compared to finding the normal average of a data set. This is because the total will reflect that some of the bits of data hold more weight or significance than others. Some will also occur more frequently than others.

There are three steps to calculating the weighted average.

1. Figure out the weight of each point of data

You can determine the weight of each of your data points by factoring in which numbers are the most important. For example, a business may put a heavier weight towards its net profit than its turnover.

When it comes to large statistical data sets such as consumer behavior data, randomized data trees can be used. This is to figure out the importance of a variable. This helps to ensure that the distribution of importance comes from an unbiased standpoint. This process is commonly performed with the help of a computer program or software.

When it comes to accounting and finance purposes, the number of units of a product tends to be used in order to weight each data point.

2. Multiply the decided weight by each value

The next step requires you to multiply the weight by each value. So for example, let’s say that you decide that the weight of one product is equal to 0.25, and the product’s value is 50. Then the weighted value for that product is 12.5.

3. Add the results of each data point together

Once you have multiplied the weight by each value point in your data set, add all of the weighted values and divide by the total assigned weight value to arrive at the weighted average.

Why Do We Use Weighted Average Method?

The weighted average method is mainly utilized to assign the average cost of production to a given product. It is commonly used when items within a business’s inventory are intertwined and it becomes difficult to assign a specific cost to any individual item.

This frequently happens when inventory items are identical to each other but were purchased at varying prices. This method also assumes that a business will sell all of its inventory at the same time.

What is the Difference Between Weighted and Unweighted Average?

The unweighted average is another way to say a simple average or the mean. So let’s say that a baker sold 0 loaves of bread (0%) on their first day of business, and 50 loaves (100%) on their second. The unweighted average for those two days combined would be:

0 + 50 / 2 = 25 (50%)

This would then come across as two reasonably successful days instead of one successful day and one unsuccessful day as the average score is 50% or 25 per day.

A weighted average would take details such as the sample size into consideration. So using the example above, let’s say that 10 loaves were sold on the first day, and 40 on the second. The weighted average would be as follows:

0% x (10/50) + 100% (40/50) = 80%

This shows a more realistic weighted average which prevents the results from being skewed by the sample size.

Examples of Weighted Averages

Weighted averages are used in a number of different areas of finance. This could be:

- Purchase price of shares

- Portfolio returns

- Valuation

- Inventory accounting

To give an example, let’s say that Company X sells pre-built computers. The company buys 200 computers for $200 per unit. The next month, they buy another 300 computers for $300 per unit.

So the weighted average cost would be as follows:

- 200 computers at $200 per unit = $40,000

- 300 computers at $300 per unit = $90,000

- Total number of computers = 500

If you were to use a simple average, then the calculation would be as follows:

- 500 computers costing $130,000

- 130,000/500 = $260 per computer

So as you can see, the weighted average has a lot more accuracy in what was spent and where. Whereas by using the simple average you can see that although the result is correct, it doesn’t tell the full story.

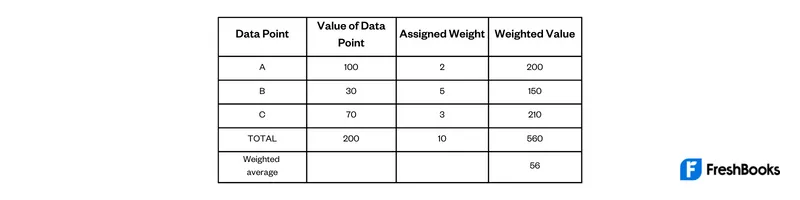

To give another example, let’s say that Company Y wants to find out the weighted value of a set of data points A, B, and C. By using the steps that we have laid out above, we can calculate the weighted average as follows:

Summary

The weighted average is a useful tool when it comes to specificity.

It can be used for simple, day-to-day business decisions but also for investors when it comes to weighing a stock portfolio. It can be difficult to keep track of the cost basis on the shares within a portfolio and their relative changes in value.

But by using a weighted average, they can calculate the share price paid for each share purchased, not just the absolute price of the portfolio.

FAQs About Weighted Average

The simple average is a less accurate method of calculation. This is especially true when it comes to more complex sets of data. A weighted average considered all of the relative importance of each value. Therefore making it a more accurate representation.

When calculating a simple average, you treat all numbers equally. You add them all together and then divide by how many data points there are. Whereas weighted average assigns a value to each data point. This determines in advance the relative importance of each number.

When it comes to times of rising prices, FIFO generally is preferable. This is so that the income is high, and the costs recorded are low. You would want to use LIFO in an economic climate where tax rates are high. This is because the costs that are assigned would be higher, and the income will be lower.

Share: