Average Annual Growth Rate (AAGR): Definition & Calculation

When looking at financial data, the average annual growth rate (AAGR) and compound annual growth rate (CAGR) are commonly used metrics.

Excel’s built-in formulas can assist in determining growth rates, but additional information is needed to calculate AAGR and CAGR.

Read on as we take a closer look at what AAGR is, the formula used to calculate it, and the uses and drawbacks of using it.

Table of Contents

KEY TAKEAWAYS

- AAGR determines the mean annual return rate on an investment.

- This measurement can account for quarterly, semi-annual and annual periods of growth.

- It’s important to use periods that are equal in length during the calculation in order to avoid estimate distortions.

- AAGR may need more financial metrics to account for compounding, volatility, and returns timing.

What is the Annual Average Growth Rate?

The average annual growth rate (AAGR) measures the compound annual growth rate of an investment over a specified period of time. It’s used to gauge the performance of an investment relative to other investments. It also compares the historical returns of different investments.

Moreover, this linear measure indicates long-term trends and the average yearly return. It’s usually expressed as a percentage. You can apply it to a multitude of financial measures.

- Profits

- Revenue

- Cash flow

- Expenses

- Sales

- Earnings

This helps investors determine which direction the company is moving in for that specific calculation. This is an important metric that we’ll look into further below.

Annual Average Growth Rate – Formula

The AAGR formula calculates the average rates of return over several years or periods. But it’s important to note that the periods used must be equal in length to find accurate growth rates.

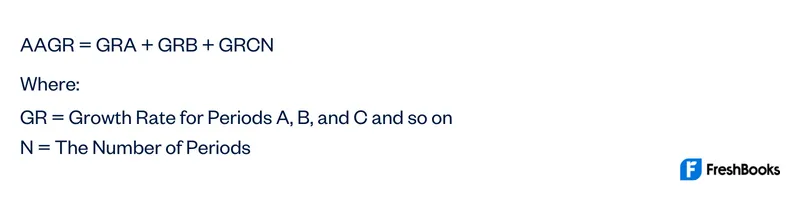

To find the AAGR, you’ll need to find several necessary pieces of information first. You’ll need the growth rate for each individual time period within the series you’re trying to find. Once you have that information you can plug it into the following formula:

This formula isn’t limited to three growth rate values. It can accommodate however many growth rates needed to find the AAGR.

For example, if investment X has the following end values across the past 4 years listed here:

Beginning value = $250,000

End year 1 value = $270,000

End year 2 value = $295,000

End year 3 value = $332,000

End year 4 value = $413,000

To get the growth rate for each year, you would use the formula for simple percentage growth:

Ending ValueBegining Value -1

Year 1: 270,000/250,000=1.08-1=8%

Year 2: 295,000/270,000=1.09-1=9%

Year 3: 332,000/295,000=1.12-1=12%

Year 4: 413,000/332,000=1.24-1=24%

From here, you plug in each year’s growth rate to the average annual growth rate formula. It should look like this:

AAGR=8%+9%+12%+24%4=53/4=13.25%

How to Calculate Average Annual Growth Rate

Annual growth rate calculation is relatively simple. Just make sure you determine the revenues or earnings for consistent periods. You’re essentially finding the mean growth rate for a set of time periods.

Many periods you’re researching are the same number of periods you would divide the aggregate spending growth increase by.

This could be for quarterly, semi-annual, and annual finances. Just be sure to use average price growth values from time periods that are equal in length. Not doing so could result in slower growth or faster growth rates.

It’s important to note that this would be an inaccurate rate of growth in spending. This is why it’s vital to use an average spending growth rate from equal periods.

Uses of the Annual Average Growth Rate

Average Annual Growth Rate statistics are usually found in a mutual fund’s prospectus. You may also find them on brokerage statements. It’s included in these documents as a simple way for investors to measure the average returns on investment over several periods.

Even though it’s used in this way, it’s not a true measure of the potential risk associated with a particular investment. This isn’t the only drawback associated with using AAGR.

Drawbacks of the Annual Average Growth Rate

There are several drawbacks to using the average annual growth rate. It’s for this reason that many investors, accountants, and financial analysts choose a different metric. This one is the Compound Annual Growth Rate (CAGR).

AAGR has a few restrictions to be mindful of. For example:

- It’s a linear metric so it doesn’t account for the effects of compounding

- It shows trends, but it doesn’t reflect changing financial trends

- Doesn’t indicate the potential risk associated with an investment like price volatility

- There’s potential for distorted slow or acceleration in growth rates if there are positive or negative returns

- Annual spending growth rates don’t factor in the timing of returns

While AAGR is good for basic estimations of average growth rates it’s rather limited overall. So instead investors and financial analysts prefer CAGR since it covers a lot of those blind spots. CAGR accounts for compounding, the timing of returns, and minimizes the return volatility.

Annual Average Growth Rate Example

Now let’s look at an example to see how the AAGR is calculated. Let’s say you have an investment that starts off at $10,000 and grows to $12,000 after two years. To calculate the AAGR of this investment, we first need to calculate the total growth.

To do this, we take the difference between the final value and the initial value ($12,000 – $10,000 = $2,000) and divide it by the initial value ($2,000/$10,000 = 0.2).

Next, we need to divide this number by the number of years in question (in this case, 2 years) to get our AAGR. This gives us an AAGR of 0.1, or 10%.

As you can see, the AAGR is a simple but important metric that tells us how much an investment has grown on average each year. It’s a useful way to compare the performance of different investments, as well as to track the historical returns of a particular investment.

Summary

Overall, average annual growth rate is a helpful metric that applies to several areas of finance. It’s great for finding the average return on an investment. But it has certain limitations that may make you want to choose a different measure to work with.

Still, this doesn’t prevent it from being a metric used in investing, accounting, and other financial areas.

FAQs About Average Annual Growth Rate

A good annual growth rate percentage for an investment depends on which sector it’s in. For example, companies in the fitness sector can expect around 2.4% annually. While a company in fraud detection might average around 24.6% annually. In general, a good growth rate percentage is anywhere from 15% to 45% annually.

The average annual growth rate for small businesses is estimated to be 15% to 25% annually. Where your business falls on this spectrum might be affected by current revenues, and the industry your small business is in.

To calculate the average annual growth rate over multiple years, you need simple percentage growth for each year’s revenue. You then divide the sum of all the percentages by the number of years.

Deputy directors are responsible for the overall management of the AAGR process. This includes setting the goals and objectives of the AAGR, as well as overseeing the implementation of the AAGR. Deputy directors also play a key role in monitoring the progress of the AAGR and making adjustments as necessary.

There isn’t a definitive answer to this question. It comes down to your objectives and individual goals. But a good rule to go by is that a healthy AAGR should be in the range of 5-10%.

Share: