What Is a P.O. Number on an Invoice and How to Use It

A P.O. or Purchase Order number is a unique number assigned to a purchase order form. The P.O. details the products or services a business wishes to receive from a particular vendor (or supplier). The P.O. number will be referenced throughout the transaction process by both the buyer and the seller.

Table of Contents

- What Is a Purchase Order?

- What Is a P.O. Number?

- How Do Purchase Orders and Invoices Work?

- What Are PO Invoices and Non-PO Invoices?

- How Do You Create a P.O. Number?

- What Information Should Be on a Purchase Order?

- Where to Include a P.O. Number On An Invoice

- Importance of a Purchase Order Number

- P.O. Number Examples

- Conclusion

- Frequently Asked Questions

What Is a Purchase Order?

Purchase orders are legally binding documents that are sent to a seller by a buyer. It is an official purchase requisition or statement of intent to buy the items listed on the P.O. at the price listed, with a promise to pay for them at a future date.

Buyers will create a purchase order listing the types of items as well as the quantities they would like to buy. These documents not only help clients buy supplies, but they also provide a detailed paper trail, keep buyers and sellers on the same page, and serve as proof in the case of a dispute.

What Is a P.O. Number?

A P.O. (purchase order) number is a number that is assigned to a purchase order so that each document has its own number, which makes it easy to find in a purchase accounting database.

A P.O. numbering system helps buyers and vendors keep track of the orders they have sent or received, guarding against incorrect filing, and it also helps buyers double-check that the charges on the vendor paperwork match what they have ordered on the P.O., helping to reduce errors and saving time.

How Do Purchase Orders and Invoices Work?

A Purchase Order is a legal document created and issued by the buyer (or client) of a product or service at the start of a transaction. It details the particulars of a sale, such as the products or services required, the amounts, and the agreed-upon pricing. A properly filled-out purchase order should be detailed enough that the seller will understand it easily without the need to ask questions. Since both parties approve the P.O., it is considered a legally binding document.

The purchase order number, usually found at the top of the form, will be referenced continuously throughout the transaction, such as in client phone calls with the purchasing department, shipping forms, and eventually the invoice.

The seller issues sales invoices throughout a project as milestones are achieved or towards the end of the project if the scope of work is smaller, following the terms outlined in the purchase order. If products are sold, an invoice is normally issued by the seller when the products are shipped. The sales invoice from the seller becomes the vendor bill on the buyer side.

As with the purchase order, it will list the details of the products or services the seller delivered or provided, quantities, and prices. It will also reference the P.O. number, so the buyer can check in their system to see if this transaction was pre-approved. Upon receipt, the buyer is expected to pay it within the terms previously agreed upon (for instance, the seller may require payments from all its vendors within 30 days).

Also Read: How Do Purchase Orders Work

What are PO Invoices and Non-PO Invoices?

A P.O. invoice is a paperwork that references the purchase order number in the actual invoice. A non-P.O. invoice means that the purchase order was not created or required for the transaction being billed for. The reasons for not generating a purchase order could include:

- The order was urgent and processed quickly (in other words, the customer did not have time to issue one).

- The transaction was under a specific dollar figure. The policy of many companies is to not provide purchase order numbers for every transaction, only for ones that exceed a specific dollar amount. For instance, a company may not require purchase orders for transactions under $10,000. If it does, a purchase order is required for management’s approval.

- The business needing the service or product is so small that they do not have the resources in place for a proper accounting or purchase order (PO) number system.

How Do You Create a P.O. Number?

It is not difficult to create a P.O. number. Many small businesses will simply start at 1 and count upwards, with their P.O. number system looking like the following: PO 001, PO 002, PO 003, etc. With a professional accounting software solution, the purchasing department can instead rely on the accounting software to automatically generate P.O. numbers as needed. FreshBooks has the solution you need. Click here to try out our accounting software and access your one-month free trial.

What Information Should Be on a Purchase Order?

Purchase orders require entering detailed information so as not to be misinterpreted later. Including all of the following information will ensure your intent is clear and there will be no follow-up questions to your order:

- The date the purchase order was created

- A unique P.O. number

- Vendor contact information, including name, phone number, and email address

- Buyer contact information and billing address

- A description of products and services you would like to purchase, including their specific names if known

- The quantity of each product that you would like to order

- Any special notes or details, such as timeframes or an expected delivery date

- The price you are expecting to pay, which will have usually already been worked out with the seller beforehand

- Relevant tax information

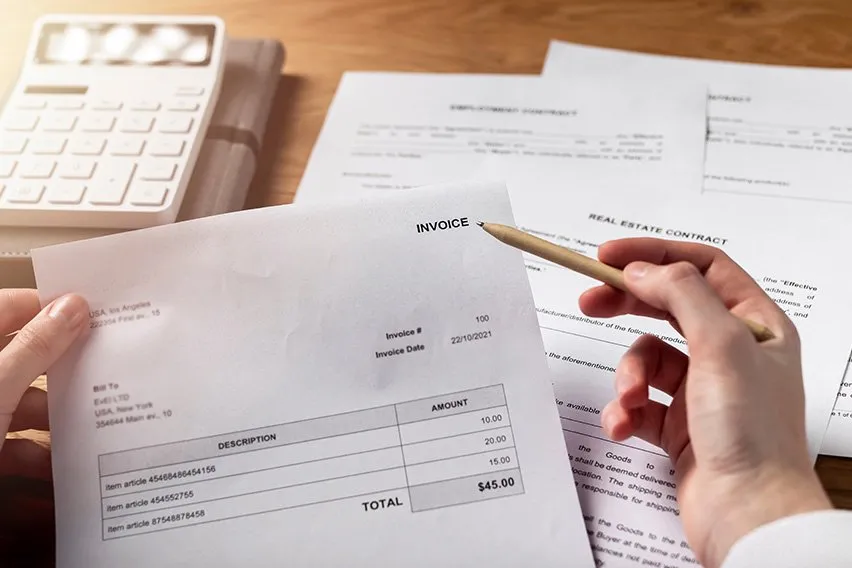

Where to Include a P.O. Number on an Invoice

The P.O. number is most often found in a specific location at the top of the sales invoice, below, or beside the invoice number. It should be labeled as the PO number to avoid confusion. This makes it easy to find a reference for a specific transaction later. If you are still determining how the P.O. number would look on your invoice, you can try out free invoice templates that will help you create an invoice with all the information where it should be. FreshBooks invoicing software can help you create professional-looking invoices in seconds. Click here to get started.

Importance Of Purchase Order Number

The P.O. number is important as it allows businesses to better track their incoming goods and manage inventory, as they will have a record of what has been ordered and what still needs to be ordered. It can help businesses with inventory management, keeping track of their spending, cash flow, and business expenses.

P.O. Number Examples

The P.O. numbering system is fairly straightforward. The buyer can create a PO number, and many will simply start with 0001, then 0002, 0003, etc. Some small business owners may add letters to their PO numbers as well to further differentiate between departments or types of stock. For example, home goods may be listed as H0001, H0002, etc., while outdoor goods may be OD0001, OD0002, etc. The entire purchase order process is made simpler when unique P.O. numbers are used, and the correct order of numbering helps too.

Conclusion

Although it is not a legal requirement, using a purchase order document to buy goods or request services, with a vendor later invoicing the buyer, can reduce misunderstandings, errors, duplicate payments, and financial issues down the line. Purchase orders are legal documents that help businesses keep accurate records of their spending, inventory, and payments. For these reasons, using a P.O. numbering system with unique P.O. numbers is often the most efficient and safest way for businesses to make transactions.

FAQs on P.O. Numbers

Who provides a PO number?

The buyer generates a unique P.O. number because the buyer sends the purchase order, as it is an agreement made by them to pay later for an order they are placing now. It is up to the purchasing party to create the correct paperwork and send it to the seller with all important details and essential information included.

Is a P.O. number the same as an invoice number?

No, a P.O. number is found on a purchase order and refers to an order placed by the buyer, who is ready to buy the goods listed on the P.O. An invoice number is found on an invoice or the bill requesting payment for these goods. Sometimes a sales bill will include the number of the corresponding P.O. along with order details, payment terms, and other relevant information.

What comes first: a P.O. or an invoice?

A P.O. (purchase order) will usually come first, as it is the expressed intent of a buyer to purchase goods and services from the seller. If a verbal agreement is made over the phone, for example, in the case of a tight timeline, a seller may send the product and invoice first, with the buyer later sending a P.O. to keep the paper trail intact.

Is a P.O. number a contract?

A purchase order is a legally binding contract. If you send a purchase order to a seller, you are obligated to buy the items or services listed. The P.O. number is the reference number found on the purchase order, a legally binding document.

Reviewed by

Jami Gong is a Chartered Professional Account and Financial System Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales. Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields.

RELATED ARTICLES

Net 30 Meaning: What Is It and How Does It Work?

Net 30 Meaning: What Is It and How Does It Work? How to Get a Client to Pay an Invoice: 8 Effective Tips

How to Get a Client to Pay an Invoice: 8 Effective Tips How to Write an Invoice Letter: A Small Business Guide

How to Write an Invoice Letter: A Small Business Guide 8 Tips to Write an Overdue Invoice Letter That Will Get You Paid

8 Tips to Write an Overdue Invoice Letter That Will Get You Paid How To Print An Invoice? Step By Step Guide

How To Print An Invoice? Step By Step Guide What Is a Vendor Invoice?

What Is a Vendor Invoice?