PayPal Limit: What’s the Minimum & Maximum Transfer Limit

The online payment giant PayPal is a well-known and useful electronic money transfer platform. Countless people and entities use PayPal to send money between verified accounts securely. It’s handy for owners and operators of online businesses who receive payment from customers via their PayPal business account. PayPal can also come in handy for other types of business, with some companies opting to pay employees or contractors over the Internet instead of through traditional checks.

Key Takeaways

- The PayPal transfer limit serves a valuable role in ensuring the security of PayPal’s users and their linked bank accounts

- For those who use a PayPal business account, you’ll need to determine if the security of transaction limits is worth the extra delay or if they’re better off having the option to exceed their transfer limit

- PayPal’s limits are fairly simple to lift, allowing you to send as much as you want in PayPal transfers without risking the security of your online banking

Here’s What We’ll Cover:

Why Does PayPal Have Transfer Limits?

PayPal Minimum and Maximum Limits for Normal Transactions

PayPal Instant Transfer Limits for Debit Cards

How to Lift PayPal’s Instant Transfer Maximum Sending Limit

Why Does PayPal Have Transfer Limits?

Like many other payment processors and electronic wallets, PayPal has transfer limits to protect its users and their PayPal balance. These limits are, above all, a security precaution intended to protect PayPal users. Imparting limits on PayPal transactions for non-verified users ensures that money isn’t sent maliciously or by error.

Transfer limits:

- Prevent unauthorized users of a PayPal account from sending too much money in a single transaction

- Prevent people from sending too much money because of a typo

- Require business owners to go through multiple identity verification steps to ensure trust

These transfer limits can be annoying at first, but they can easily be lifted by verifying your identity with PayPal, adding a linked bank account, and more. Let’s explore these maximum and minimum PayPal transfer limits and how you can prevent them from affecting your business.

On the plus side, the outgoing PayPal transfer limits prevent someone from clearing out your bank account should they gain access to your PayPal. This maximum limit resets, so while it’s not foolproof, it provides some added security for PayPal users.

The other benefit of a maximum transfer limit or transaction limit is that you don’t risk sending too much money due to a typo. Even one extra digit is a huge financial error—making this mistake can cause major issues for a business’ cash flow. You can correct your error before sending money, thanks to the maximum transfer limit.

These can be handy features to protect your bank account and business cash flow. However, they can also be frustrating for those who depend on PayPal to send or accept payments, especially businesses that rely on it to send money internationally, receive money from clients and customers, or transfer funds to employees.

So how does PayPal work in this regard? What are the platform’s transfer limits? How do they change for different cards and accounts? Let’s have a look.

PayPal Minimum and Maximum Limits for Normal Transactions

Normal PayPal accounts have a minimum transaction amount of $0.01 and a maximum transaction amount of $4,000. You can also withdraw up to $500 from a bank account per month. People who don’t have a PayPal account can also send one-time payments of up to $4,000 to another person.

But you can lift PayPal’s transfer limits by verifying your PayPal Business account. When you verify your account with PayPal, you provide the platform with more information about your identity. This eliminates security risks. Once verified, you can send up to $60,000 per transaction. You’ll also have no limits on how much money you can send from your account overall.

Small business owners and freelancers should verify their accounts as quickly as possible. Having a higher maximum limit and/or withdrawal limit lets you use PayPal as a more reliable payment method. Freelancers, additionally, can accept payments online more quickly when verified.

Verifying Your Account

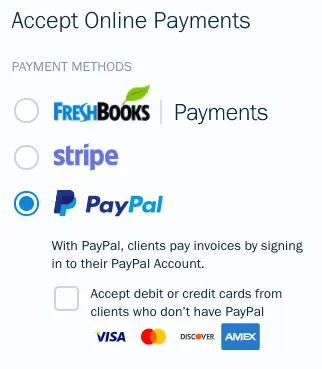

You can verify your PayPal account by:

- Applying for and being approved for PayPal Credit

- Linking a bank account, debit card, or credit card

For many business owners, linking a bank account is both useful and the easiest way to get verified. To link a bank account to your PayPal Wallet and verify your identity:

- Enter your PayPal profile

- Click “summary” and confirm your email address and/or phone number if you haven’t already done so

- Click “Wallet” and “Link a bank” in the top left-hand corner (alternatively, you can verify by linking a credit card)

- You can then enter your bank account information, including its location, name, routing number, and account number

- After providing this information, PayPal will make two small deposits from your PayPal into your bank account

- A verification email will be sent once the deposits are made in a few business days. Keep an eye out for your verification email (it might go into your ‘junk’ inbox) and respond promptly.

- Identify the two PayPal payments (usually just a few cents each) and enter the deposit amounts in your PayPal account

- PayPal will then grant you “Verified” status, lifting your PayPal transfer limit

PayPal Instant Transfer Limits for Debit Cards

PayPal also offers an “Instant Transfer” service. This service allows you to send money from PayPal to an eligible bank or debit card account within 30 minutes. You can also accept money quickly using this feature.

The PayPal transfer limits for debit card payments are:

- $1.00 minimum transfer amount

- $5,000 maximum transfer amount in a single transaction

- $5,000 maximum transfer amount per day

- $5,000 maximum transfer amount per week

- $15,000 maximum transfer amount per month

PayPal Instant Transfer Limits for Linked Bank Accounts

PayPal’s Instant Transfer limit for banks is simple: a flat maximum of $25,000 per transaction and a minimum transfer of $1.00. This amount is significantly higher than the limits for debit cards. This is because users must link their bank account and debit card to PayPal to take advantage of this feature. Thus, their identities are already verified.

How to Lift PayPal’s Instant Transfer Maximum Sending Limit

You can’t lift the maximum transaction limits for PayPal’s Instant Transfer feature. PayPal keeps these restrictions in place due to the instant nature of the transactions. This protects business owners from losing too much money in the case of fraud or theft.

However, business owners can make instant transfers as often as they like when using a linked bank account. PayPal limits work on a per-transaction basis, not overall.

Conclusion

PayPal is a practical and sometimes essential tool for businesses of all shapes and sizes. Like all resources, however, you need to know and understand the finer details to make the most of it for your business. In the case of PayPal, some of these rules and processes can be a little overly complex, making self-education even more critical.

But if you’re searching for an online finance tool that never leaves you scratching your head, FreshBooks is here to help. Our accounting software is simple to use, full of useful features, and fully secure. Plus, our accounting services link directly with PayPal. Click here to learn more about FreshBooks and sign up for free.

FAQs On Paypal’s Limits

Can you PayPal someone $10,000?

Yes, but not with a regular account. While the PayPal transfer limit for normal users is $4,000, verified users can send or accept a maximum of $10,000 in a single payment. Additionally, users with a linked bank account can send a maximum of $25,000 per transaction. To learn more about this follow our guide How to Send Money to PayPal from Bank Account.

How do I check my PayPal limit?

First, log into your PayPal account online via the PayPal site to view your current PayPal transaction limits. Select your preferred payee and enter an amount. If the amount you enter is too high, you’ll be notified of your limit by PayPal.

Why is my PayPal on limit?

Typically, limits are applied to new and unverified PayPal accounts. PayPal may also limit your account if they suspect unauthorized activity or other security issues with your PayPal account. They’ll send you a verification email and additional information if this is the case.

How do I avoid PayPal limits?

Verifying your account is the best way to get around PayPal’s transaction limits. You can do this by adding a linked bank account, debit card, or linked credit card or by signing up for PayPal credit.

What is the highest PayPal Credit limit?

PayPal Credit, PayPal’s virtual, low-limit, revolving line of credit program, has a starting limit of $250, but it can be theoretically increased over time to $20,000 via limit increase requests. This is separate from the limit for PayPal accounts with a linked credit card.

Reviewed by

Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

RELATED ARTICLES

How Long Does Direct Deposit Take: A Guide to Direct Deposit

How Long Does Direct Deposit Take: A Guide to Direct Deposit What Is PayPal Credit? Virtual Credit for Online Shopping

What Is PayPal Credit? Virtual Credit for Online Shopping How to Send Money on PayPal?

How to Send Money on PayPal? How to Send Money on Cash App: A Complete Guide

How to Send Money on Cash App: A Complete Guide What Is a Contactless Payment? A Complete Guide

What Is a Contactless Payment? A Complete Guide What Are PPP Loans? How the Paycheck Protection Program Works

What Are PPP Loans? How the Paycheck Protection Program Works