Small business software that makes the hard part easy

Less admin, more success

50% off for 6 months

Customers and experts recommend FreshBooks

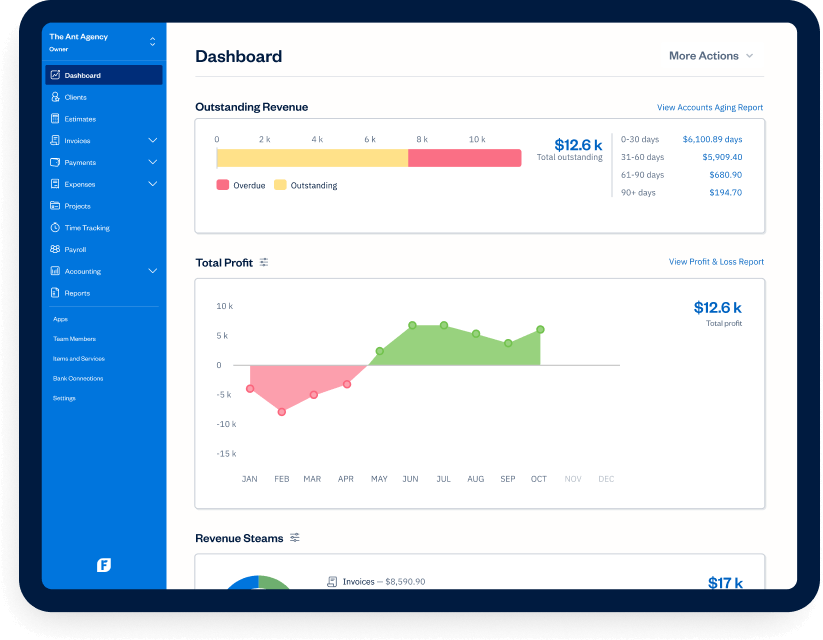

The features you need.

All in one place.

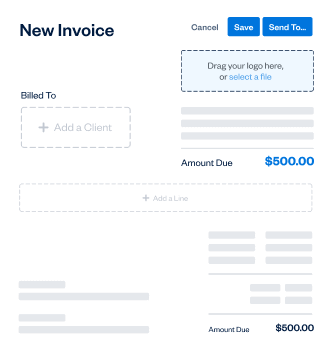

Invoicing

Create professional invoices in minutes. Automatically add tracked time and expenses, calculate taxes, and customize your payment options.

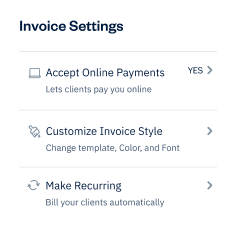

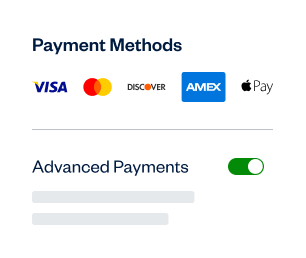

Billing and Payments

Bill fast, get paid even faster, and automate the rest with recurring invoices, online payments, and late payment reminders.

Expenses

Keep track of your expenses with mobile receipt scanning, bank account imports, and automated expense categorization.

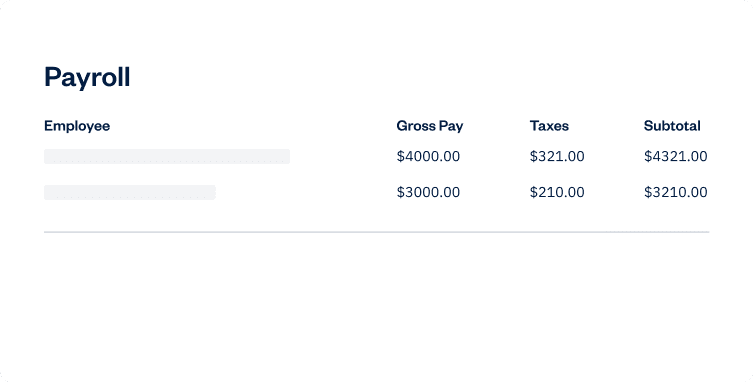

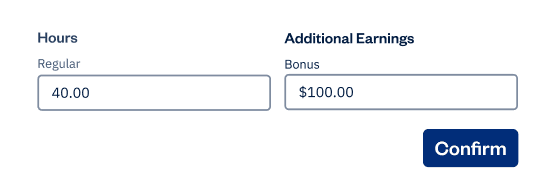

Payroll

The simplest way to pay yourself and your team. Seamlessly run payroll, track expenses, and calculate taxes without juggling separate tools.

Use FreshBooks

your way

Freelancers

Keep your books in check, your clients happy, and your work on track.

Solopreneurs

Keep your books in check, your clients happy, and your work on track. Invest in accounting software that respects your time so you can spend it on building your business, not crunching numbers.

Businesses with employees

Save time (and money!) by using FreshBooks to collaborate with your team while handling accounting, billing, and payroll.

Businesses with contractors

Stay organized and informed about your daily operations, and keep everyone you work with on the same page.

Use FreshBooks

your way

Don't take our word for it,

take theirs

FreshBooks has really helped me to be more efficient throughout the year so that tax time…it’s less stressful

Damona Hoffman

Dear Mrs D, Inc.

More reasons to love FreshBooks

553hrs

Save up to 553 hours each year by using FreshBooks

160+

People in over 160 countries have used FreshBooks

$7000

Save up to $7000 in billable hours every year

30M+

30M+ small businesses have used FreshBooks

100+ apps.

Infinite possibilities.

Fuel growth and save time with the FreshBooks AppStore.

See All Apps

Grow stronger with FreshBooks

Build an integration, use our API, or reap the rewards of our affiliate and referral programs. Explore the benefits of the Accounting Partner Program for accounting professionals. Look no further for your next growth opportunity!

Become a Partner10K+

Businesses have partnered with FreshBooks

Support that actually supports you

Help From Start to Finish

Our Support team is knowledgeable and never transfers you to other departments.

4.8/5.0 Star Reviews

Yup, that’s our Support team approval rating across 120,000+ reviews

Global Support

We’ve got over 100 Support staff working across North America

Help From Start to Finish

Our Support team is knowledgeable and never transfers you to other departments.

Frequently Asked Questions

Ready to get started?