Why Values-Based Accountant Nicole Believes FreshBooks Truly Cares About Customers

Updated on January 7, 2026 | 6 min. read

For CPA Nicole Long of Breath & Taxes, people (and good customer service) matter just as much—if not more—than the numbers.

ℹ️ COMPANY

Breath & Taxes LLC

💼 INDUSTRY

Accounting

📍 LOCATION

Portland, OR

❌ PROBLEM

Frustration with other software due to ethical concerns, poor customer support, and complexity for her clients.

✅ SOLUTION

FreshBooks' intuitive, user-friendly platform, with exceptional, human-centric support.

😃 RESULTS

Easier financial management for business-owner clients.

For CPA Nicole Long of Breath & Taxes, people and good customer service matter just as much—if not more—than the numbers.

If you ask a small business owner what qualities they’re looking for in an accountant, they’re likely to say “accurate,” “efficient,” and (let’s be honest) “affordable.”

One important word is missing from that list, though, and it’s perhaps the single quality that best defines CPA Nicole Long: empathetic.

In 2020, Nicole started therapy after suffering from depression and grief—a journey that eventually led to the founding of her Portland, Oregon-based accounting, tax, and financial coaching business, Breath & Taxes (a play on “death and taxes”). Since then, holding space for her clients and communicating with intention has become a regular part of her accounting practice.

“Finance—especially tax in America—is deeply traumatic,” explains Nicole. “We have this system that really instills fears in people.”

Another key to Nicole’s practice is FreshBooks, her accounting software of choice. We spoke with Nicole about why she believes personal beliefs have a place in accounting and why she thinks FreshBooks’ people-first approach reflects her own value systems.

How did Breath & Taxes get started?

Nicole: I was working in a corporate job, and I actually quit for a mental health break. I was pretty depressed, and I knew I just needed to take some time for myself. After about 6 months, I decided I wanted to become a therapist. Then, I was on LinkedIn and saw an old connection from my first job at PwC had posted a job for a startup that provides tax services to therapists. It was exactly what I was looking for. I joined that company and worked my way up into operations until I was managing the entire accounting and tax operations in the company.

It taught me a lot. I realized that instead of becoming a therapist, I wanted to have a client base made up mostly of therapists or service-based businesses. I realized that I didn’t need to go back to school to be in a helping field; I could instead use my knowledge from a therapeutic perspective. So, I started saving money, and two months later, I was able to start Breath & Taxes. My clients are mainly small businesses, including mostly therapists, acupuncturists, tattooers, physical therapists, and writers.

Why do you think it’s important to bring your personal values to the forefront of marketing your business?

Nicole: In almost every job I’ve worked, I felt like I had to compromise my own values to show up in the space—whether it was at the corporate job where I was analyzing sales reports with explosives that we were selling to government and entities, or having to make decisions that would negatively affect or risk therapists and their practices. I think it was actually one of the reasons why I was depressed.

Being able to start my own business and show up exactly how I am has made my job way easier because it’s very clear how I work and who I am. I think that people who resonate with that will come work with me—and the people who don’t won’t. I also feel like I can build on my idea of self, growing in ways that excite me, following paths that I’m curious about. My business is now an outlet for creativity and connection.

How does your interest in mental health play into how you approach your accounting practice?

Nicole: My joke is, “I’m a financial therapist.” I wouldn’t actually label myself as that because I don’t have that credential. But the way I’ve worked in my own therapy and the way I’ve grown with my own relationships is how I want to show up in my business and financial space. I want it to be a place where people can practice non-judgment and work through really difficult things.

So I have an almost therapy-like approach and a lens of openness that then educates people. Ideally, I’m giving people the tools—the same way a therapist would—to fix their problems if they needed to do it on their own.

How did FreshBooks first get on your radar as a tool for yourself and your clients?

Nicole: I wanted a solution that was not Intuit because I do not support any Intuit products for ethical reasons. They acquire and swallow, remove competition, and actively lobby to make tax filing harder for Americans. It’s one of the reasons why we don’t have free, good, accessible tax filing software—because Intuit’s TurboTax has a chokehold. The number of errors that I [see] from people who self-prepare through Intuit’s software? It’s terrifying—because if everyone’s off by a couple of hundred dollars, think about the impact on millions of people. It’s wild.

I tried to learn more about the investing side of prospective accounting software. Like, where’s this money coming from? I saw that FreshBooks is a Canadian company, which I liked. Once I started working with FreshBooks, I felt like the support was different from others—it was human-first support. I’ve really appreciated the humanness of FreshBooks.

I personally use FreshBooks in my own practice. It’s very easy to use, and I really enjoy being able to talk to the engineers and give real-time feedback. It makes invoicing extremely easy for service-based businesses like mine.

Which clients benefit most from FreshBooks and why?

Nicole: I encourage FreshBooks for people who care about seeing their financial reports and who want human support. Also, for anyone doing consulting like me, who issues invoices and gets paid that way, FreshBooks is great for that.

Business owners who are service-based, like myself, who want to invoice their clients will benefit a ton. I love the invoicing feature and its ability to take various payments, include different terms, and list out services.

Are there any FreshBooks features that really stand out for you?

Nicole: I really like the dashboard—the breakdown of expenses is cool to look at. I hope they build that out even more. It’s really helpful information for my clients.

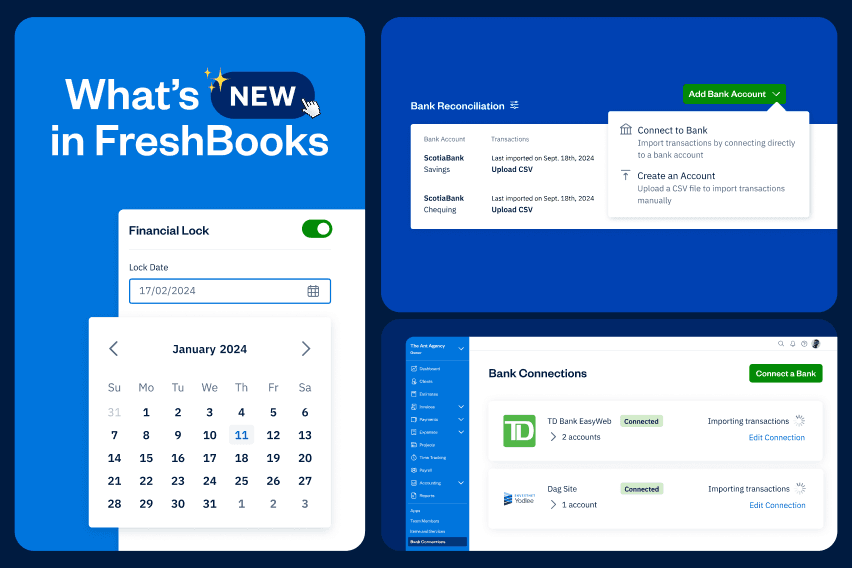

I love the changing features released each quarter or year. The financial lock was important in keeping historical data preserved. The financial reports are also nice to look at, with the sub-categories and totals listed in parent categories.

How do you typically work with your clients in FreshBooks?

Nicole: My clients know how to navigate FreshBooks, and we can communicate asynchronously. They leave me notes on whatever expenses come through, like if something is personal. When I see the notes, I mark those transactions as Owner’s Draws. Outside of this, we don’t have AR or AP to track, so it’s actually quite simple. My clients are versed in reviewing reports while I dig into the more nitty-gritty details.

I also created a bookkeeping coaching program centered around FreshBooks. I recorded videos and created written content so that people can train themselves on how to use FreshBooks best.

How does FreshBooks help business owners and their accountants work together?

Nicole: FreshBooks is way more intuitive software than others. It’s definitely for small businesses and solopreneurs. I haven’t had any negative feedback from my clients. For the most part, using FreshBooks seems very clear. They know where to go for things like Uncategorized Expenses. They leave me notes in the expense when it comes through, and I do the bookkeeping when I’m able to. That’s really nice.

Cloud-based accounting software is the future; it is the place where collaboration can happen. More and more people are moving away from desktop versions so that they can include employees, partners, advisors, and accountants.

The company is making changes that align with the needs of the people they’re servicing—that alone is enough to invest in something. I really do believe FreshBooks cares about the people they’re servicing.

What’s next for Breath & Taxes?

Nicole: My long-term goal is to create a space where I can hire people who want to open their own accounting businesses but just need a little bit of oversight and support. I would take on employees for one or two years max, with the goal of getting a lot more caring, community-based accountants out there in the world.

I’m also launching an S-Corp workshop. I want people to know not only what an S-Corp is, but also when it’s a good time for them to transition. If that transition is right for them, I want them to know how to do it and what it takes to be in compliance with the IRS and other state tax authorities.