🌟 KEY TAKEAWAYS

An accountant can help with many aspects of your business

You can use a bookkeeper or accounting software to manage your needs

It’s advisable to involve accountants in your tax returns

Accountants cost money, but they save you time, so consider the weight of each

You don’t need to have an accountant employed full-time

There are many benefits to utilizing accountants within your small business

Sometimes it’s tough deciding on what type of help you need for your small business, because that help is going to cost you money. In this article, we are going to answer the top 10 questions you should ask yourself when deciding whether you need an accountant for your business.

Here’s what we’ll cover:

Can I Do My Small Business Accounting Myself?

What Can an Accountant Do for Me?

Do I Have the Time to Do My Own Accounting?

Do I Know How to File an Income Tax Return for My Small Business?

Maybe I Hire an Accountant Part-Time

Maybe I Need a Bookkeeper Instead?

Does My Small Business Have Problems with the Government?

What Happens to My Business Long Term If I Don’t Hire an Accountant Now?

How Accountants Can Help Every Small Business

Accounting Software To Manage My Business Finances

1. Can I Do My Small Business Accounting Myself?

Just how much do you know about accounting? Do you understand the difference between single-entry and double-entry bookkeeping systems? How about the meanings of FIFO or LIFO? What’s an Income Statement? If you can’t answer these questions, and you feel you should be able to, or maybe some of this terminology has come up in conversation at your business, it could be time to bring in an accountant.

2. Am I Tech Savvy?

Perhaps you use computer software every day, and you play with some apps from time to time but don’t consider yourself an ‘expert’? This may not have been a problem regarding accounting software. Chances are, you’ve got other things to focus on anyway, like selling your product or service. However, there are very user-friendly accounting software systems out there, which are meant for people without accounting experience. You want a program that can easily keep track of your invoices and expenses, as well as generate income statements and other reports. Before hiring an accountant, accounting software might be a place for you to start.

3. What Can an Accountant Do for Me?

Do you understand what an accountant can bring to the table? This can help you decide whether it’s worth hiring one.

An accountant can help you with small things like bookkeeping, payroll, and complying with tax regulations. They can also handle the bigger stuff like data management, financial analysis, and the generation of financial reports and can also ensure that your company meets regulatory compliance with its accounting practices.

For a full breakdown of an accountant’s duties, please consult “What is the Difference Between Bookkeeping and Accounting.”

4. Do I Have the Time to Do My Own Accounting?

Maybe you’re on the road constantly. Maybe you’re being pulled in many directions; your clients need your input, or your employees need detailed guidance with your startup. The phone doesn’t stop ringing, and the emails keep piling up in your inbox. Whatever the reason, maybe you simply don’t have the time to do the company’s accounting. If that’s the case, it may be a relief to hand this responsibility off to someone whose specialty is accounting.

5. Do I Know How to File an Income Tax Return for My Small Business?

Many new business owners don’t understand how to file taxes, which becomes a problem at tax time. Owners spend so much time concentrating on getting their businesses off the ground, making new contacts, and obtaining clients, that taxes were something they would worry about “next year.” But tax time comes fast.

Are you aware that many business owners simply file their personal and business taxes together in one return? These types of businesses are referred to as “pass-through” entities. This means the profit is only taxed once. In late 2017, the Trump administration introduced the Tax Cuts and Jobs Act (TCJA). Although there are certain restrictions, the TCJA allows for a new tax break for small business pass-through entities, an equivalent of up to 20% of its income.

The TCJA also changed what’s deductible, what’s not, and the amounts. So maybe it’s time to consider consulting an accountant, at least for your company’s first tax filing. An accountant will best be able to tell you what’s allowable and what’s not. However, if you want to learn more about the types of taxes, ways to file, and how to file taxes efficiently, you can check out our article on Small Business Tax Filing, which provides detailed explanations and a video guide for better understanding.

6. Can I Afford an Accountant?

Accountants don’t have a standard or regulated rate. The amount you pay will depend on the individual you want to hire, the education and work experience of that person, and the level of service your business requires from the accountant.

The 2017 median pay for an accountant, according to the Bureau of Labor Statistics, was $69,350.

7. Maybe I Hire an Accountant Part-Time?

Consider that maybe you don’t need an accountant full-time, maybe it’s just part-time, perhaps a couple of days a week. You can map out this person’s time in advance. Maybe half the accountant’s time is spent working on the ‘paperwork’ the company is continuously generating in relation to its income and expenses, and maybe the other half of his time is spent in consultation with you on accounting strategy. This will include his advice, based on the financials, on how to best spend your company’s money on resources required to keep the business profitable.

If you still need clarity, consider reading our article on Hiring a Bookkeeper for a Small Business. In it, we explain the duties and responsibilities that an accountant has, as well as ways to find the right person for the job.

8. Maybe I Need a Bookkeeper Instead?

Sometimes a new business just needs some help getting organized with its income and expenses. Maybe there’s not a tremendous amount of transactions (or there are), but little or none of it is being recorded properly. That’s where a bookkeeper comes in.

A bookkeeper is not an accountant. State or federal governments require no formal training for someone to call himself a bookkeeper, nor is there a bookkeeper designation. But a bookkeeper’s job, mainly that of recording transactions properly as it relates to a company’s income and expenses, is important. That’s because the interpretation of those numbers will influence management’s financial decisions.

A bookkeeper with some experience can recommend an accounting software solution to track the company’s income and expense payments and manage that system. They can help you develop bookkeeping policies and procedures and make your company more efficient by training your team on how to enter their own expenses. They can handle the trips to the bank and troubleshoot discrepancies in the data captured by the software.

A bookkeeper will cost you less than an accountant. According to PayScale, a website that provides salary and compensation information for a wide array of industries, a bookkeeper, on average, earns approximately 41K annually.

PayScale notes the average hourly rate is under $17.00 per hour.

Hiring a bookkeeper may be a cost-effective solution for your business. But again, a bookkeeper is not an accountant. You may hire an accountant occasionally to meet with your bookkeeper and consult on whether the system you have in place is adequate.

9. Does My Small Business Have Problems with the Government?

If you do, and the IRS wants to take a look at your books, then you may need a CPA. A CPA, or Certified Public Accountant, is exactly that – certified. Hiring a CPA means you have someone working for you who is educated, experienced, and considered an expert in the accounting field.

A Certified Public Accountant can prepare an audited financial statement or act as your representative in front of IRS Revenue Officers or Counsel. An accountant cannot do these things.

Remember that a CPA is also very well paid, and although rates vary, they are typically much higher than an accountant's. Chances are you don’t need one full-time. So, weigh your problems with what may happen if you don’t get professional help. The expenditure may be worth it.

10. What Happens to My Business Long Term If I Don’t Hire an Accountant Now?

Consider your business now. How fast is it growing? Perhaps you’re working late two nights a week just to keep up on the accounting. Perhaps you feel that’s worth it, so you have a good grasp on the financials at any given time.

But now, ask yourself, is this workload sustainable? Or would you rather have someone who can just give you the top-line summaries when needed? This way, you can step back from the details and focus on the big picture, where you need to be as a business owner. This will allow you to make better financial decisions for the long-term health of your company.

How Accountants Can Help Every Small Business

Accountants can help you understand and manage your company’s taxes, growth, and expenses. Ensuring your taxes are paid promptly and accurately is key to keeping your business running smoothly, so it can help to have a tax planning expert. Accountants can also analyze your financial statements and clarify where you might be able to reduce expenses and increase profits. This can help you develop strategies to grow your business more efficiently.

Accounting Software To Manage My Business Finances

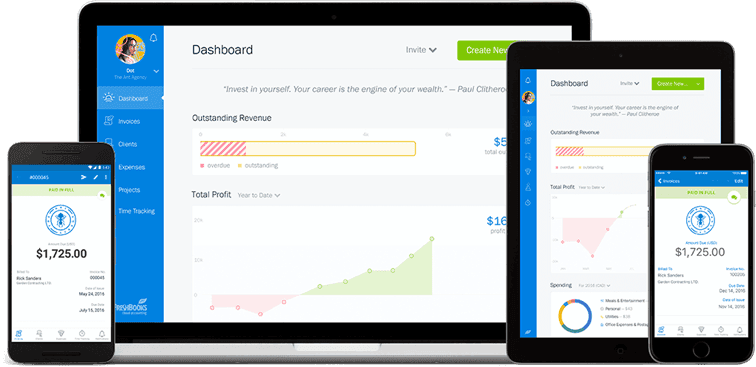

Accounting software can help you organize your payroll, send and receive payment for invoices, and organize your small business taxes. FreshBooks accounting software offers a wide range of accounting services so you can keep track of your own business expenses and profits.

If you’re unsure where to start with your small business accounting, the FreshBooks blog offers helpful articles about running your small business, managing your accounts, and using an accounting system to grow your business.

Conclusion

Deciding whether you need an accountant for your business depends on your business size, goals, and how comfortable you feel with accounting. If you have the time and expertise, accounting software can help you save money by managing your business finances. If you’re short on time or don’t feel confident with your bookkeeping, hiring a small business accountant can help you understand your business’s cash flow and ensure tax season goes smoothly.

FAQs on Do I Need an Accountant for My Small Business

Can you Run a Business Without an Accountant?

Depending on the size of your business and how confident you feel with accounting, it’s possible to run a business without an accountant. If you run a smaller business and are comfortable managing your own account, software that can help you organize your accounting by yourself. For larger companies or those who don’t feel confident with bookkeeping, hiring an accountant can help keep your taxes, profits, and growth calculations running smoothly.

How Much Does a Small Business Spend on Accounting Costs?

Accounting costs vary greatly depending on the type of services you need. According to a 2015 survey of small business owners, most small businesses spend at least $1000 annually on accounting and legal expenses. This increased for larger companies and more complex accounting tasks.

Do I still need an accountant if I use accounting software?

Accounting software is great and can manage a lot of your needs. However, it is recommended that you get your tax return checked and approved by an accountant or someone in the accounting field every year. If you have a larger or more robust business structure, like a limited company or LLC, you probably shouldn’t do your own tax return because it takes a lot of time and expertise to do so.

At what point do I need an accountant?

That all depends on your situation. You might want an accountant for any of the reasons we discussed above. Further, if you have had any big life changes recently, you’re self-employed, or you need to make changes to a previous year’s tax return, it’s also good to employ the services of an accountant.

What accounting is needed for a small business?

There are 3 key reports involved in small business accounting. They are the balance sheet, cash flow statement, and income statement.