60% Off for 3 Months Buy now & save

Grow your business with

Buy Now, Pay Later from Affirm

Let your clients pay for your work over time, while you get paid upfront. It's a win-win: flexible for them, and risk-free for you.

Get Started for Free

Secure more high-value projects

Struggling with cash flow or clients who hesitate over budgets? Buy Now, Pay Later solves both problems. It lets clients pay over time, so you can close more deals, upsell premium services, and maintain a steady cash flow—giving you a serious competitive edge.

Sell more with Buy Now, Pay Later

Turn more quotes into invoices

With flexible payment options, clients are more likely to commit to projects, so you can get started faster with fewer hurdles.

Confidently offer premium services

Flexible payment options don't just close deals. They increase their size by enabling clients to accept premium services and full-scope projects without the burden of upfront costs.

Keep your cash flowing

With Buy Now, Pay Later, you get paid in full upfront while your clients pay in installments.

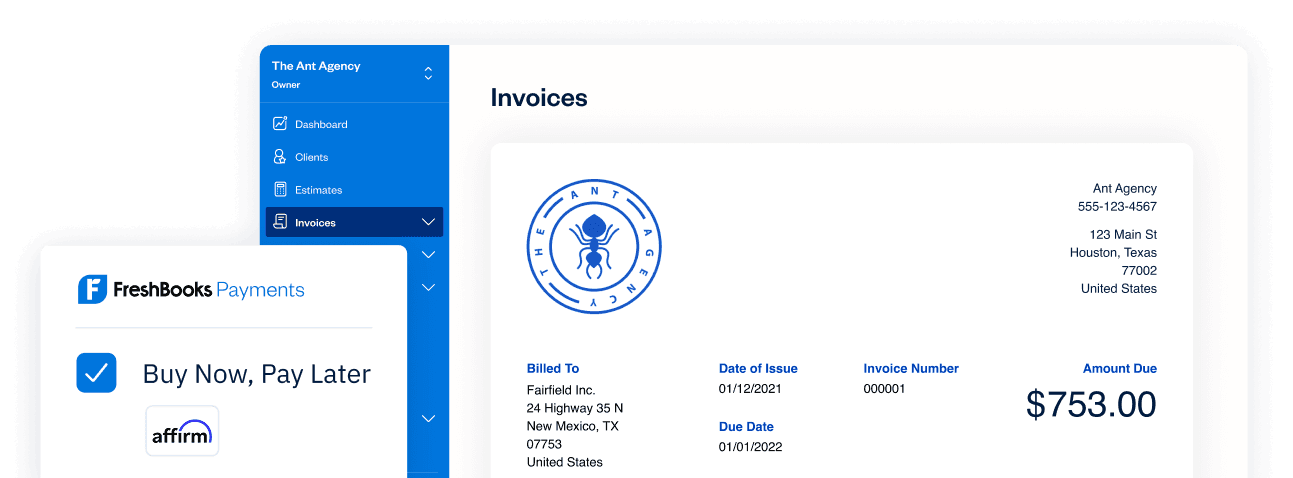

Add Buy Now, Pay Later to your invoices

STEP 1

Send your FreshBooks invoice

Simply select Buy Now, Pay Later as a payment option on your invoice. Note: This feature is exclusively available with FreshBooks Payments.

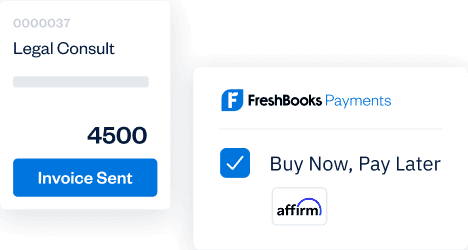

STEP 2

Your client chooses to pay over time with Affirm

Once your client chooses to pay with Buy Now, Pay Later, they’ll go through Affirm’s quick and transparent approval process.

STEP 3

Enjoy seamless transactions

With any Affirm payment option, you always get paid upfront (minus the transaction fee), and Affirm handles the rest.

Promote Buy Now, Pay Later to your clients

Buy Now, Pay Later (BNPL) can make your services more accessible and help close deals faster. By offering clients the flexibility to spread out payments, you can remove cost barriers and win projects that might otherwise stall.

Share this with your clients

We’ve created a shareable web page that explains how Buy Now, Pay Later works, answers common questions, and even lets clients get pre-approved with Affirm. Send it before proposals or include it in your welcome materials.

Tips to use BNPL to your advantage

Mention it early

Bring up BNPL before pricing becomes a sticking point.

Position it as an upgrade path

Show how BNPL can make higher-end packages, add-ons, or extra features more attainable. For eligible clients, depending on approval and terms.

Make it part of your pitch

Include a simple line like, “We offer flexible payment options if budget is a concern.”

We want to help you succeed. That’s why FreshBooks resources make it easy to let clients know you now offer Buy Now, Pay Later.

Simple, transparent pricing with FreshBooks Payments and Affirm

6% + $0.30 per transaction

Affirm handles all repayments, so you carry no risk for BNPL transactions.

Customers get clear, fair terms with no fees or credit checks, and transparent interest.

Businesses see a 70% lift in average order value when offering Buy Now Pay Later with Affirm.*

More than 50 million consumers are looking to use Affirm to make purchases.**

* AOV lift (+70%) based on purchases made from July 1, 2023–June 30, 2024: Source

** Addressable users (more than 50 million) and active merchants (more than 323,000) as of Sept. 30, 2024: Source

Frequently Asked Questions

Ready to get paid faster and win bigger deals?

Offer flexible payments to your clients, and get paid in full immediately. It’s the easiest way to increase sales and improve cash flow—without taking on any risk.

Get Started for FreePayment options through Affirm are subject to an eligibility check, may not be available everywhere, and are provided by these lending partners: affirm.com/lenders. For Affirm Terms of Service, please visit https://stripe.com/legal/affirm

Canada residents: "Payment options through Affirm Canada Holdings Ltd. (“Affirm”) are subject to an eligibility check, and depend on purchase amount, payment terms, vary by merchant, and may not be available in all provinces/territories. Minimum purchase and down payment may be required.